Expert Opinion: Analyzing European Commission Merger Decisions

Share

Read the Expert Opinion by Rashid Muhamedrahimov and Andrew Tuffin

Merger regulators exist to prevent mergers and acquisitions that would substantially harm competition. In performing their duties, two key issues arise: accuracy and speed.

In each case, the decision-making process matters. Decisions need to be thorough, well-reasoned, and well evidenced. A regulator that errs in either direction – by approving harmful transactions or by blocking benign deals – harms competition and consumers’ interests. However, decisions need to be thorough without being burdensome. Extensive enquiries come at a cost, potentially delaying beneficial agreements or causing them to be abandoned.

So, how effective is the European Commission (EC)’s review process? Experience tells us a great deal, but it can overemphasize the importance of specific cases. What are the facts for the process as a whole? To answer this question, the Data Science team at Compass Lexecon built a unique dataset of EC merger decisions, which analyzes 7,823 cases between 1990 and 2020, and uses machine learning to read and interpret almost 100,000 pages of decisions. Our analysis provides some preliminary insight into how the EC merger review process is working.

KEY INSIGHTS

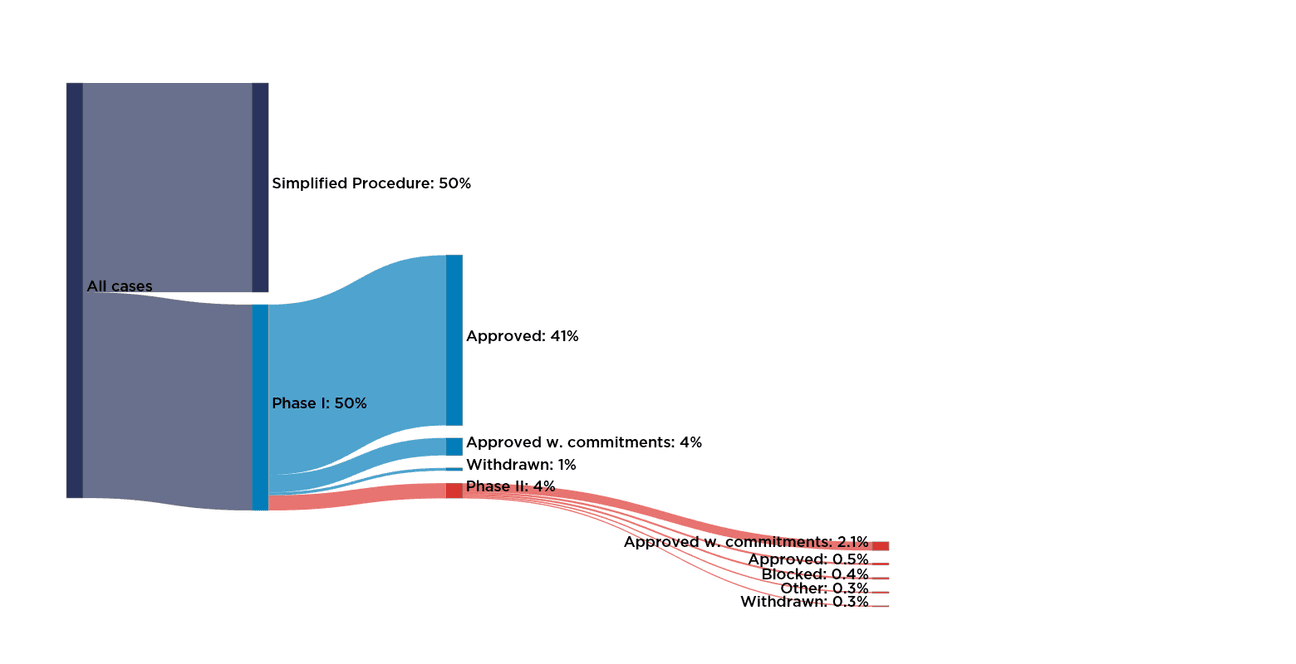

- Most parties are affected by whether the EC reviews straightforward transactions quickly and efficiently – 91% of all cases are approved in Phase I without commitments. (See image above showing case outcomes between 1990 - 2020)

- Trends suggest the EC’s merger review process is increasingly efficient on average – its ‘Simplified Procedure’ accounts for nearly three-quarters of all cases since 2015 and that proportion has been growing.

- Phase II investigations take considerably longer than they used to. The time that elapses between notification and decision has increased from about 25 weeks in the mid-2000s to over 30 weeks in recent years.

- Decisions are getting lengthier – Phase II decisions have increased from about 50 pages in the early 2000s to about 250 pages.

- There has been a shift in the types of evidence that the EC considers in its decisions – identified using automated text analysis to categorize the types of evidence each decision referred to.

- Merger control does not appear to have tightened. Since 2000, the EC has blocked, or approved with commitments, a broadly constant proportion of the cases it assesses.