Assessing vertical integration between hospitals and insurers

Share

The effects of vertical integration can vary and often depend on the specific setting of a merger. Carlos Noton and Angelos Stenimachitis[1] set out how these should be assessed in transactions involving healthcare providers and insurers – which exhibit additional forces to the typical vertical integration case – and discuss the factors that determine their impact on consumer welfare.

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Introduction

The trend towards vertical integration in health care markets has attracted attention from policymakers and researchers. In the economic literature, the effects of vertical integration are theoretically ambiguous. The main arguments in favour of vertical integration typically involve solving the double marginalization problem,[2] encouraging efficient investment, and aligning incentives within the vertical chain to induce the efficient use of resources (such as manufacturing arrangements or informational exchanges).[3] At the same time, vertical integration may grant market power to integrated firms and may induce foreclosure, which could harm consumers. The EC’s guidelines on non-horizontal mergers (“the Guidelines”) describe two types of foreclosure: input foreclosure and customer foreclosure. Input foreclosure is performed by an upstream firm which restricts the access of downstream firms to important inputs, thereby raising their costs or forcing them to find alternative inputs; customer foreclosure is performed by a downstream firm which restricts the access of upstream firms to their customer base.[4]

Moreover, the impact of vertical integration is particularly ambiguous in private healthcare markets, as additional forces arise in mergers between hospitals and insurance companies. There has been speculation about whether vertical integration in these markets will reduce health care costs through better management and cost control or increase the market power of integrated firms and induce exclusionary practices towards rival firms.[5] The net effect on consumer welfare depends on many different aspects of each market such as consumer preferences, firms’ cost structure, and regulations.

Whether the potential harms outweigh the potential benefits is an empirical question that stresses the need for careful empirical analysis in each case. In this article, we set out how the conflicting effects of vertical integration can be analysed in “non-standard” settings, such as those involving healthcare providers and insurers. We draw on recent research that examined the Chilean healthcare market, and its implications on the potential effects of a merger – between a group of private hospitals and a provider of insurance policies – recently completed in Greece.[6] The cases both exhibit additional incentives that are not present in the “standard” vertical integration scenario. We discuss how those factors affect consumer welfare, and – depending on the specific circumstances of the case – how they can reduce welfare, even when traditional analyses would suggest otherwise. For that reason, a thorough understanding of the forces affecting welfare and an empirical assessment of their impact is essential.

A framework to assess the effects of vertical integration between insurers and healthcare providers

The structure of vertical supply chains in healthcare markets

In a “standard” vertical supply chain, consumers only have a direct relationship with the downstream retailer. For instance, consumers of cable TV might pay a monthly subscription to a cable TV operator. But those consumers will be indifferent to the fees that their cable operator negotiates with the upstream content providers. It only matters to them if the operator adjusts their subscription fee to pass on any changes in its own costs.

The vertical integration between insurers and hospitals creates additional layers of complexity compared with this “standard” scenario, as shown by Cuesta, Noton and Vatter (2019).[7] The principal difference is that, in a “non-standard” scenario, consumers have a direct relationship with both levels of the supply chain.

The “non-standard” structure of vertical relationships in healthcare markets occurs where households (final consumers) enrol with downstream insurers paying a regular insurance premium for a healthcare plan. Then, downstream insurers negotiate with upstream hospitals to agree upon the prices the hospital will charge the insurer’s customers for treatments they might subsequently require from that hospital. Where an insured customer requires treatment, they are free to choose between rival hospitals based on the treatments and prices that each hospital has agreed with the customer’s insurer. This “non-standard” vertical structure resembles the structure of the healthcare markets in Chile, where vertically integrated insurance providers and hospitals are pervasive, while in Greece, this is a novel but growing phenomenon.

This “non-standard” setting describes the healthcare and insurance markets in Chile, Greece, and many other countries. In effect, in healthcare markets, consumers acquire an insurance plan that gives them an option to access upstream hospitals and purchase services directly from them at a given price schedule.[8] Importantly, insurers do not provide full compensation for hospital bills; consumers “co-pay” a fraction of the treatment prices that their insurer negotiated with the hospital they choose.

The potential efficiencies of vertical integration

To analyse the impact a vertical merger would have in such a market, firstly one needs to quantify all sort of efficiencies that benefit consumers. In the healthcare market, the potential candidates for sources of efficiencies will be broadly the same as those in standard supply chains.

Firstly, integration might eradicate double marginalization, where the independent insurers and hospitals set profit margins that exceed the combined profit margin that an integrated company would set. Double marginalization is bad for consumers, as they pay higher prices. It is also bad for insurers and hospitals, as it prices out some consumers, to the extent that total profits will be less than they would be under a lower combined profit margin. An integrated company would set prices to maximise its total profits, which would also be cheaper for consumers.

Secondly, merging the insurers and hospitals could reduce costs if the combined companies use resources more efficiently. For example, billing and customer services might be cheaper and more efficient in a larger and integrated player.

Even if integration would generate efficiencies, we still need to consider to what extent an integrated provider would pass those benefits on to consumers, increasing their welfare.

On the one hand, the merged entity might pass-on a proportion of those efficiencies. In some circumstances, the integrated insurer might offer lower insurance premia and/or negotiate lower rates treatment prices with hospitals (whether its integrated partner, or rival hospitals); either way it could attract more insurance customers. Similarly, the integrated hospital up stream could also negotiate lower treatment prices with insurers (whether its integrated partner and/or rival insurers); either way, it could attract more customers seeking treatments.

On the other hand, Cuesta, Noton and Vatter (2019)[9] demonstrate two mechanisms through which the integrated parties might negotiate prices to steer demand from rival hospitals and insurers towards its own services, potentially foreclosing rivals and in some circumstances, harming consumers.

- First, integrated hospitals have incentives to steer demand to their integrated insurers by negotiating higher hospital prices with rival insurers, denoted as “the enrolee-steering effect”. This effect has been previously referred to as “raising your rival's cost”.[10]

- Second, integrated insurers have incentives to steer demand to their integrated hospitals by negotiating higher prices with rival hospitals, denoted as the “patient-steering effect”. This incentive stems from the non-standard structure of the health care market.

Both patient- and enrolee-steering effects can be broadly identified with partial foreclosure, as at their limit, they could lead to downstream and upstream exclusion.

Analysing the impact of circumstances on incentives.

How an integrated provider sets prices – for itself and for its rivals – will depend on circumstances specific to the situation. If the integrated hospitals or insurer have very low market share, there might be few concerns. It could leverage its reduced costs to set lower treatment prices and insurance premia to attract consumers. It is unlikely to be able to raise costs for rival hospitals or insurers profitably.

Alternatively – if, for example, the integrated company has a large share of either market – it might distort prices to steer consumers toward its services. The strength of these steering incentives depends on consumers’ price sensitivity, and their potential impact on consumers can be complicated.

Cuesta et al. (2019) find that the net effect on consumer welfare of the enrolee and patient steering effect depends on whether consumers are more sensitive to treatment prices than insurance premia or the converse. In general, more price-sensitive consumers will foster competition, and firms will lower prices more aggressively. However, more sensitive consumers also make it more profitable to distort prices to favour integrated partners in this context.

The interaction of these different effects means that vertical integration in these non-standard markets can have positive consequences on consumer welfare, but they can also harm consumers even in circumstances where an analysis of the forces in standard vertical relationship – such as those between cable TV operators and content providers – would not raise concerns. That is why the nature and impact of these factors needs to be assessed empirically in each case.

Applying the framework in practice: Chilean and Greek healthcare markets

Concerns about integration in Chile

Cuesta, Noton and Vatter (2019) applied their framework to analyse the Chilean private health care market that provides an excellent setting for studying the effects of vertical integration. Only a small number of private hospitals and insurers compete, and vertically integrated firms account for almost half of private hospital admissions. Consumers choose among a variety of plans and, whenever they require health care, choose hospitals (that might or might not be integrated) and pay their share of the bill.

At face value, vertical integration affects consumers’ prices and choices. For instance, the full price of admissions at an integrated hospital is 7.9% lower when a patient comes from an integrated insurer, and patients from integrated insurers pay 23% less out of their own pockets than patients from non-integrated insurers. Additionally, consumers with an integrated insurer are 10% more likely to visit hospitals integrated with that insurer, despite facing unrestricted choices.

However, simple statistics can be misleading as we cannot disentangle whether integrated firms are lowering their own prices or increasing rivals’ prices. For a robust assessment of the impact integration has on consumers, one needs a structural analysis. Building upon the structural models in the literature, Cuesta, Noton and Vatter developed a toolkit to compute counterfactual scenarios under different vertical arrangements, using counterfactual simulation to assess the impact on profits and consumers’ welfare.[11]

Using the estimated model, they show empirically that the enrolee- and patient-steering effects are relevant in the Chilean case. They conclude, based on the specific circumstances they observe in this instance, that “banning vertical integration [would be] welfare enhancing (…) as the gains in consumer surplus and insurer profit [would] more than compensate decreases in hospital profits. Furthermore, this result [would] not change qualitatively for a range of cost efficiencies induced by vertical integration”. However, that finding is not generalisable, even within Chile. Different circumstances could have led to the opposite conclusion.

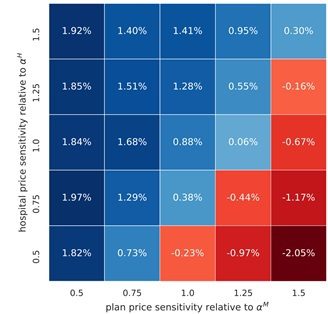

For illustration, Figure 1 demonstrates how changes in circumstances, even minor ones, would alter the assessment of how vertical integration affects consumers of Chilean healthcare. The red (bottom right) corner of Figure 1 shows the set of scenarios where banning vertical integration would reduce consumers’ welfare, and the blue region shows the scenarios where banning vertical integration would benefit consumers. The impact depends on how sensitive consumers are to two sets of prices: the premium of the insurance plan; and the price of healthcare in hospital, should an insured customer require treatment. The vertical axis shows that, as consumers’ sensitivity to hospital treatment prices increases, a ban on vertical integration would increase consumer welfare. That is, the more that consumers seek to avoid higher treatment costs, the more profitable it is for an integrated firm to distort prices, so banning vertical integration will benefit consumers. The horizontal axis shows that the more that consumers are sensitive to the insurance premium, integrated firms will not find it profitable to steer consumers and banning vertical integration would harm consumers in Chile.

We must stress that these patterns are specific to market features, so results in Chile will not represent general findings. For instance, differences in consumer preferences and regulations will affect the variation in services that insurance plans and hospitals can offer, and therefore the counterfactual equilibrium outcomes will differ in each situation.

Figure 1: Effect on consumer welfare of banning Vertical Integration in Chile

Implication of the Framework for a proposed merger in Greece

The European Commission recently considered a proposed merger between a Greek insurer and healthcare provider: Ethniki Insurance, the largest issuer of health insurance in 2020;[12] and CVC is the largest private healthcare provider, which is active in private health services in Greece through its operating vehicle, Hellenic Healthcare Group – the majority owner of six of the largest private hospitals and a large network of primary care centres.

The Greek healthcare market is structurally similar to the Chilean one in several aspects. The markets in both countries exhibit a structure where a small number of health care providers and insurers compete; there are public and private insurers and hospitals in both markets; and public hospitals are considered an outside option.

As in Chile, private hospitals are paid by patients, and Greek insurers do not reimburse the full costs of treatment; patients must themselves pay a fraction of the treatment prices negotiated between insurers and hospitals. The extent of insurer contributions and range of treatment available varies. All employed Greek citizens are automatically enrolled to the public health insurance system (EOPYY - Ε.Ο.Π.Υ.Υ.), which only covers a small proportion of any payment to private hospitals (or other healthcare providers) when they provide some types of treatments, and nothing for other types of treatments. At the same time, private healthcare insurance generally covers most of the costs associated with these treatments and cover a wider range of treatments. Patients that receive treatment in a private hospital (or similarly for a service) that is not included in their private insurance policy are not eligible for any compensation for that treatment by their insurer.

As in Chile, treatment prices are negotiated between hospitals and insurers, and then offered to the insurer’s customers. When they need treatment, consumers have a free choice between hospitals covered by their insurance plan, but their insurers are a primary source of information, so they are able to steer patients towards specific hospitals even though no primary Greek insurers have until recently been integrated with healthcare providers.

Given its similarities to Chile, the structure of the Greek healthcare market could, in principle, create incentives for integrated players (insurers and hospitals) to negotiate hospital prices with rivals that would steer patients and enrolees towards their integrated partners. In particular, as the merging parties are the leading players in their respective relevant markets, which might cover half of admissions in particular locations (particularly Attica, the wider Athens region), there appeared to be a risk that the post-merger market could closely resemble that of Chile.[13] As patients in both countries appear to value the proximity of hospitals, the Merged Entity could have held significant market power in some geographies (but not others). Additionally, the Merged Entity will be the only vertically integrated provider and the only one with the full breadth of private healthcare offering.

Given the potentially close similarities between the Chilean market and the Greek market, we invited the European Commission to model and inspect the proposed transaction closely. Depending on its specific circumstances, the merger could have posed a threat to consumers (as integration in Chile does) or had a positive impact. The EC has unconditionally approved the transaction, suggesting that – in this case – the specific circumstances in Greece might be sufficiently different from those in Chile to alleviate concerns; at the time of writing, its written decision is forthcoming.

Analyse the specifics

Whether any distortions outweigh the potential benefits of vertical integration are empirical questions that stress the need for careful empirical analysis in each case. Comparing the cases of Chile and Greece emphasises two general lessons when assessing the potential impact of vertical mergers:

- be specific about the details of market structure and how they affect incentives, rather than just classifying a merger as vertical or horizontal – in this case, incentives differ from the standard vertical scenario because consumers can discriminate between both downstream providers (insurers) and upstream providers (hospitals); and

- counterfactual simulation, when employing the appropriate framework, can provide a helpful tool to understand these impacts, and whether a merger will benefit or harm customers

Policymakers should be cautious not to instinctively restrict themselves to conventional theoretical literature on vertical integration for the purpose of competition policy decisions. Different industries exhibit different competitive dynamics (e.g., retail or consumer goods to healthcare or digital markets) and vertical integration might have marked benefits on transaction costs or detrimental effects to consumer choice, depending on the particular case.

View the PDF version of this article.

Read all the articles from the Analysis

[1] The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees, or its clients. This article is partially informed by advice provided to a complainant in the context of the European Commission’s investigation into the acquisition from CVC Capital Partners (‘CVC’) of Ethniki Insurance.

[2] The double marginalisation problem refers to the state where independent companies in a vertical supply chain add profit margins that exceed the combined margin an integrated company would set, and thereby reduce total profits and harm consumers.

[3] See Spengler, J. J. (1950). Vertical integration and antitrust policy. Journal of political economy, 58(4), 347-352; Williamson, O. E. (1971). The vertical integration of production: market failure considerations. The American Economic Review, 61(2), 112-123; and Grossman, S. J., & Hart, O. D. (1986). The costs and benefits of ownership: A theory of vertical and lateral integration. Journal of Political Economy, 94(4), 691-719.

[4] See Hart, O., Tirole, J., Carlton, D. W., & Williamson, O. E. (1990). Vertical integration and market foreclosure. Brookings papers on economic activity. Microeconomics, 1990, 205-286 and Ordover, J. A., Saloner, G., & Salop, S. C. (1990). Equilibrium vertical foreclosure. The American Economic Review, 127-142. See European Commission (2008). Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings. Retrieved from: https://eur-lex.europa.eu/lega...

[5] See VOX (2017). What the CVS-Aetna merger could mean for health care deals, drug prices, and Amazon. https://www.vox.com/business-a..., as well as https://www.reuters.com/articl...

[6] See M.10301 – CVC/Ethniki

[7] See Cuesta, José Ignacio and Noton, Carlos and Vatter, Benjamin, Vertical Integration between Hospitals and Insurers (January 2, 2019). Available at SSRN here or DOI here.

[8] On how healthcare markets are modelled as upstream and downstream see Ma, C. T. A. (1997). Option contracts and vertical foreclosure. Journal of Economics & Management Strategy, 6(4), 725-753, and Trish, E. E., & Herring, B. J. (2015). How do health insurer market concentration and bargaining power with hospitals affect health insurance premiums? Journal of health economics, 42, 104-114.

[9] See Cuesta, José Ignacio and Noton, Carlos and Vatter, Benjamin, Vertical Integration between Hospitals and Insurers (January 2, 2019). Available at SSRN here or DOI here.

[10] On RRC see Salop, S. C., & Scheffman, D. T. (1983). Raising rivals' costs. The American Economic Review, 73(2), 267-271.

[11] First, they estimate discrete choice demand models for upstream hospitals and downstream health insurance plans using rich data on hospital and plan choices, prices, premiums, and consumer demographics. Second, they estimate a supply side model characterized by a Nash bargaining model where insurers and hospitals negotiate admission prices based on their outside options and bargaining skills.

[12] The taxonomy of insurance markets in this case separates insurance in to two segments: “life” insurance, which includes health insurance; and “non-life”. Third-party estimates show that Ethniki had a market share of 31.4% in the “Life insurance” market in 2020 (see Table 3 in Greek).

[13] See Atal, Juan Pablo. "Lock-in in dynamic health insurance contracts: Evidence from Chile." (2019).