Do four-to-three mobile mergers harm consumers?

Share

In the last decade, Competition Authorities have become sceptical about four-to-three mergers between mobile network operators. In this article, Jorge Padilla, Thilo Klein, Paul Reynolds and Martin Wickens [1] evaluate studies on the effects of such mergers, which show they have led to a higher service quality without increasing prices. Therefore, there is no sound basis to presume such a merger will likely harm consumers. Instead, careful assessment of the likely effects on prices and service quality is needed to determine whether a particular merger will make the consumers worse or better off.

This article summarises a study commissioned by Vodafone UK Limited and Hutchison 3G UK Limited. The full study can be found in the latest edition of the European Competition Law Review here.

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Introduction

Since 2010, the European Commission (“EC”) has investigated seven four-to-three mergers between mobile network operators (“MNOs”) in Europe and the UK. At the time of publication, two further investigations, concerning Orange and MasMóvil in Spain (conducted by the EC) and Vodafone UK Limited and Hutchison 3G UK Limited in the UK (conducted by the UK Competition and Markets Authority – “CMA”), are ongoing.

Regulators’ stance with respect to horizontal MNO mergers has hardened substantially over time. The first three four-to-three mergers – in Austria (Orange and H3G), Ireland (O2 and H3G), and Germany (Telefonica and E-Plus) – were approved with relatively limited intervention. However, the EC’s decisions were criticised as being too lenient, risking harm to competition and consumers. Since then, authorities have been more stringent. In 2015, two Danish MNOs (Telia and Telenor) abandoned their proposed merger after the EC signalled a concern that competition would be harmed unless a new fourth operator entered the market. In 2016, the EC prohibited Hutchison’s proposed acquisition of Telefonica UK. The EC did approve the Wind 3 Italia joint venture in 2016, but only on the condition that sufficient spectrum and sites were transferred to a new entrant. In 2018, the EC approved T-Mobile NL’s acquisition of Tele2’s Dutch operations unconditionally, but this was based on the EC’s finding that Tele2 was struggling and unlikely to remain as an effective competitor absent the merger.

Across the Atlantic, the US authorities approved the Sprint/T-Mobile merger in 2020, subject to conditions including divestments to Dish Network and commitments to ensure that the 5G rollout achieved targets for coverage and average downloads speeds.[2]

Is it true that the EC’s early approach to four-to-three MNO mergers was too lenient, and has the more stringent approach adopted in later investigations been justified? If so, then a review of market developments since these mergers should find that at least the earlier transactions raised prices and/or reduced service quality to the detriment of consumers.

To investigate whether these mergers harmed consumers, we have reviewed empirical studies which estimate the effect of specific mergers on market outcomes (in relation to which we focus on four-to-three mergers).

There are significant differences between the findings of existing studies of the effects of earlier four-to-three mobile mergers on price, investment, and quality.

Some differences can be attributed to the specific characteristics of the mergers and countries considered, which suggests that market-specific and merger-specific factors matter. Understanding why the effects have varied depending on the nature of the merger (e.g., characteristics pertaining to the merging parties) and on the market circumstances - e.g. the significance of Mobile Virtual Network Operators (“MVNOs”), which are providers that do not have their own infrastructure, but instead purchase network connectivity wholesale - may provide insights into the likely effect of a new transaction. Where market conditions and technologies differ, it would be important to consider how those differences might change the effects of a new merger compared with the effects of previous mergers.

There are also differences between studies of the estimated effects of the same mergers. Some of these appear to result from different measures of prices and quality showing different trends. This increases the importance of understanding to what extent the examined prices and quality are likely to reflect the prices and quality experienced by most customers or at least significant segments of customers. It also cautions against relying on any single study as offering a full assessment of a merger’s effect or to predict the likely effects of a new merger. As we set out in this article, some studies also have methodological flaws.

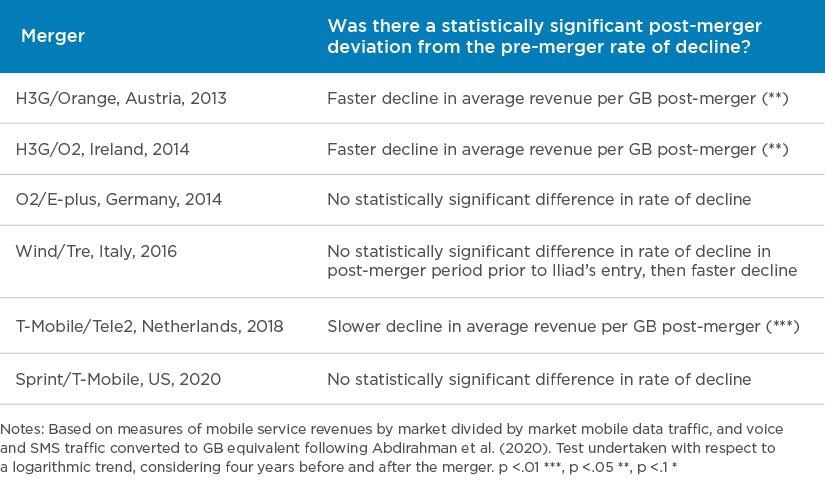

We have also considered whether the earlier mobile mergers affected the rate of decline in average revenue per gigabyte (“GB”) consumed, which we use as a proxy for quality-adjusted prices.

Four-to-three mergers had limited effects on prices, if any

An overall assessment of the studies reviewed shows that the mergers had little impact on prices, typically having no effect at all, or increasing prices for some customers for a short period only.

The EC was criticised for approving the three earlier mergers, in Austria, Ireland, and Germany. But with hindsight, none of them had a sustained negative impact on prices. Studies find that, in Ireland, the merger had no statistically significant price effect.[3] In Austria and Germany, customers with low data usage did face higher prices a year or so after the merger, but for a limited duration only before prices reverted to the levels expected from control countries without mergers.[4]

The circumstances peculiar to the Italian and Dutch mergers may reduce their relevance as barometers for four-to-three mergers elsewhere. Nonetheless, they are not bad omens. In Italy, in the short period before a new operator entered due to the structural remedies imposed by the EC (returning the market to a 4 MNO market), the merger appeared to have no impact on prices. After entry, prices plummeted – as the entrant brought new capacity into the market and priced aggressively to grow its customer base from nothing.[5] In relation to the Dutch merger, the EC noted reasons as to why the fourth MNO’s position and pricing impact may not have been sustainable even without the merger.[6] Nonetheless, after the Dutch merger, prices continued to fall in absolute terms, and relative to the European average.

In the US, mobile prices are generally higher than in other OECD countries, albeit around the median when adjusting for quality, cost, and demographic differences between countries.[7] However, the effect of the Sprint/T-Mobile merger on prices was negligible. On the contrary: since the merger, real term revenues per customer – which from a consumers’ perspective is the cost they actually incur – have fallen steadily.[8]

Many four-to-three mergers appear to have led to higher quality

Far from leading to increases in absolute prices, four-to-three mergers in Europe have generally led to lower quality-adjusted prices. These transactions have generally improved mobile service quality – for instance, by extending network coverage and/or increasing download speeds.

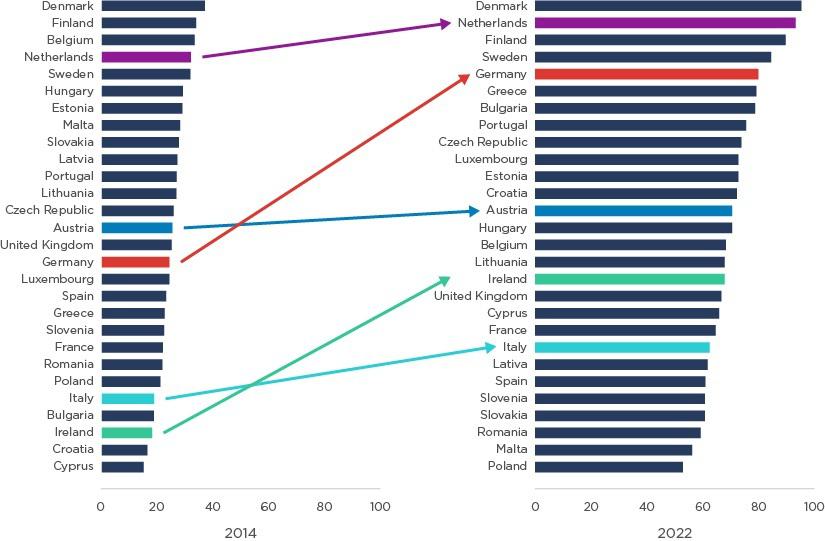

In Ireland, since the merger, the quality of the country’s networks, as measured by the GSMA’s [9] network performance index, has increased relative to other European countries (see Figure 1). Germany’s network performance improved from the 16th best in Europe in 2014 – the year of the merger – to the 5th best in 2022. In Austria, the picture resulting from the studies is less clear. Of two studies, one found a decrease in typical 4G download speeds, and the other found that the merger led to greater coverage and higher speeds. Overall, Austria’s network performance increased from 14th best to 13th best.

The Italian and Dutch networks have also increased their rankings in Europe for performance since the respective mergers. In Italy, the merged entities have gone from having slower speeds than their competitors before the transaction, to having the fastest network in the country afterwards. The network performance of the Netherlands, which was already high, improved further from 4th to 2nd best in Europe.

Similarly, in the US, before the merger, T-Mobile had the second fastest network (albeit with poor coverage) and Sprint had the slowest. By July 2022, the merged entity provided speeds about double those of its competitors. Following the merger, the US has been among the leading countries in terms of network investment per capita and 5G coverage.

Figure 1: GSMA network performance index (countries with mergers over period improved network quality relative to the others)

These improvements are important in their own right, but they may also be instructive when considering the likely effect on investment when market “laggards” merge – which is potentially the case in the UK, as Vodafone UK Limited and Hutchison 3G UK Limited are the smallest MNOs. A merger can transform laggards, intensifying the competition to lead the market. That accelerates investment in new technology, because “neck-and-neck” competition to lead means that each competitor risks falling behind if it delays investment, which is a less credible threat when competing against a laggard.[10] In the US, merging two market laggards to create a third competitor with sufficient scale accelerated the deployment of 5G.[11] Similarly, in Austria, creating a third competitor at scale increased investment and hastened the roll-out of 4G.[12]

Four-to-three mergers generally led to better value for money

With limited effect on prices but with better quality, the four-to-three mergers since 2010 appear to have provided customers with better value for money. Officials from the UK Office for National Statistics (“ONS”) and academics have proposed using revenue per unit of data supplied as a parsimonious indicator of changes in quality-adjusted prices.[13] This is on the basis that improvements in coverage, increasing speeds and new services can be expected to lead to more data usage at any given price level. We have built on this approach by undertaking new analysis of whether the four-to-three mergers led to a change in the rate of decline in average revenue per GB of data consumed.

In two cases – Austria and Ireland – average revenue per GB declined faster after the merger than before it. In the US, Italy and Germany, quality-adjusted prices continued to fall at the same rate (see Table 1). In the Netherlands, revenue per GB did not decline as fast post-merger – this appears to be largely due to slower growth in data volumes from 2019 onwards as mobile prices in the Netherlands continued to fall to below the EU average. Further, the EC’s T-Mobile/Tele2 merger decision suggests that the pre-merger rate of decline in average revenue per GB might not have been sustained in the Netherlands absent the merger, i.e. it notes that Tele2’s competitiveness and quality was declining and that some of the pre-merger decline in prices was the result of significant additional capacity from the deployment of new spectrum.[14]

Table 1: Effects of four-to-three mergers on rate of decline in average revenue per GB consumed [15] [16]

Policy conclusions

The evidence that four-to-three MNO mergers have improved quality without increasing prices may seem surprising. Competition authorities generally find that mergers are at best neutral in their impact on competition and may in some cases lead to higher prices and/or lower quality.

The evidence does suggest distinctive features of mobile technology. Mobile network consolidation generally increases capacity. That is because the capacity each operator supplies is a product of its sites and its spectrum. Consolidating two networks into one is not additive; it is multiplicative, providing more capacity than the sum of its former parts. This may help explain why the speeds of the merged parties’ network improved relative to rivals in the US, Italy, and other countries. Greater capacity also supports the parties in offering more data at any given price, which can lead to falling quality-adjusted prices.

The range of results found in the empirical literature highlights the importance for authorities to consider a wide evidence base when deciding whether to allow a specific transaction to proceed. Differences in price series and quality metrics raise the importance of identifying which metrics are likely to be most reliable and representative. It is also important to consider whether the assumptions underlying a specific methodology are consistent with the market evidence.

Nonetheless, these studies on past mergers indicate that four-to-three mergers had either no significant effects on prices or had a time-limited effect only and potentially only for some service bundles. The evidence also suggests that past mergers have in many cases led to quality improvements. Our analysis of average revenue per GB as a proxy for quality-adjusted prices finds that four-to-three mergers generally have either led to no change in the rate of decline in quality-adjusted prices or have accelerated that decline.

The track record of four-to-three mobile mergers, therefore, shows that there is no sound basis for a presumption that they are likely to harm consumers. Instead, assessing the impact that a four-to-three merger will likely have requires careful assessment of both likely price and quality effects in light of specific merger and market characteristics, and, potentially, a need to weigh offsetting effects so as to determine whether consumers will be better or worse off overall.

The full study can be found in an upcoming edition of the European Competition Law Review.

View the PDF version of this article.

Read all articles from this edition of the Analysis

[1] Jorge Padilla is Senior Managing Director, Head of Compass Lexecon Europe and Member of the Global Executive Committee at Compass Lexecon. Thilo Klein is an Executive Vice President at Compass Lexecon. Paul Reynolds is a Senior Vice President at Compass Lexecon. Martin Wickens is an Economist at Compass Lexecon. The authors thank Zsolt Hegyesi and Nina Nguyen for their assistance. The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients. The article is partly informed by work the authors carried out in merger cases, including in various of the cases cited in this article, and it summarises a study commissioned by Vodafone UK Limited and Hutchison 3G UK Limited – the full study can be found in the latest edition of the European Competition Law Review here.

[2] Specifically, commitments to deploy 5G to 97% of the population within three years and to 99% of Americans within six years, and for 90% of Americans to have access to mobile speeds of at least 100 Mbps within six years.

[3] See Body of European Regulators for Electronic Communications. (2018). BEREC Report on Post-Merger Market Developments - Price Effects of Mobile Mergers in Austria, Ireland and Germany.

[4] See (i) HSBC. (2015). Supersonic European telecoms mergers will boost capex, driving prices lower and speeds higher; (ii) Frontier. (2015). Assessing the case for in-country mobile consolidation: A report prepared for the GSMA; (iii) Body of European Regulators for Electronic Communications. (2018). BEREC Report on Post-Merger Market Developments - Price Effects of Mobile Mergers in Austria, Ireland and Germany.

[5] Based on Compass Lexecon’s analysis of the mobile telephony price index quarterly series, reported by AGCOM, from ISTAT.

[6] The EC noted that Tele2’s competitiveness and quality was declining and that some of the pre-merger decline in prices was the result of significant additional capacity from the deployment of new spectrum. For example, see EC T-Mobile NL/Tele2 NL merger decision (2018), p.489, p.511 and p.453 (“The additional capacity resulting from this spectrum increased the ability and incentive of market players to compete more aggressively for new subscribers by offering larger data bundles coupled with lower prices.”).

[7] The US Federal Communications Commission found that mobile broadband prices in the US were the 12th cheapest out of a comparison group of 26 OECD countries after adjusting for country-level quality, cost and demographic differences (2022 Communications Marketplace Report, para. 363).

[8] See Asker and Katz (10-15-2022), Figure 2, p. 40. This is based on producer price index data for Wireless telecommunications carriers as constructed by the BLS (series id PCU517312517312) and the consumer price index for Wireless telephone service as constructed by the BLS (series id CUUR0000SEED03) after adjusting for changes in the aggregate CPI level (using series id CUUR0000SA0) since January 2016.

[9] The GSM Association (GSMA) is a non-profit industry organisation that represents the interests of mobile network operators worldwide.

[10] Aghion, P. et al (2005). “Competition and innovation: an Inverted U-Relationship”, The Quarterly Journal of Economics, 120(2), p. 719.

[11] A range of evidence shows that post-merger, investment and quality in the US has grown at a faster rate as compared to pre-merger. However, it should be noted that these do not necessarily show that investment and quality grew at a faster rate due to the merger. Data from CTIA shows that the rate of growth of total investment in the US wireless industry grew much more significantly post-merger than pre-merger; with total investment growing gradually from $26 billion in 2017 to $30 billion in 2020 but jumping to $35 billion in 2021 (i.e., a year after the merger) and then continuing to grow to $39 billion in 2022 (see CTIA. (2023). 2023 Annual Survey Highlights. Prior to the merger, AT&T had the fastest download speeds, with T-Mobile and Verizon similar speeds and Sprint the slowest speeds. (OpenSignal. (2020). USA - Mobile network experience report, January 2020. A July 2023 Opensignal report states that T-Mobile’s download speed had grown to be about double its competitors and that T-Mobile leads across most mobile experience categories. (Opensignal. (2023). USA - Mobile network experience report, July 2023. Ookla reports on evidence from New York and Philadelphia where T-Mobile was first able to utilise Sprint’s spectrum which shows large increases in download speeds following the merger. (Ookla. (2020). How T-Mobile’s Merger with Sprint is Changing the Game for 5G, May 2020.

[12] We found that, based on data from GSMA, H3G reached almost ubiquitous 4G coverage a year earlier than its competitors. A range of other evidence shows that post-merger, quality in Austria grew at a faster rate as compared to pre-merger. Based on RTR data, we found that following the merger, H3G went from having relatively slow average download speeds to overtake even Telekom Austria in 2015. T-Mobile then increased its speeds in 2016 to close the gap with the others and the ranking of the three operators have fluctuated since then. The FCC collects data on mobile download speeds for 28 countries which showed a significant improvement in Austria’s overall country rank: from 20th in 2014 to 7th in 2016. (Federal Communications Commission (2018). International Broadband Data Report – the Sixth Report, Table 8, p. 36.)

[13] Abdirahman, M. et al. (2020). A Comparison of Deflators for Telecommunications Services Output. Economie et Statistique, 517-518–519, p. 116.

[14] For example, see EC T-Mobile NL/Tele2 NL merger decision (2018), p.489, p.511 and p.453.

[15] The Wind/Tre merger in 2016 reduced the number of network operators in the market from four to three; however, the remedy package agreed with the EC allowed the entry of Iliad in May 2018 as a new mobile network operator, which restored the four-player structure. The result for Italy in Table 1 considers the post-merger period to end in Q2 2018, the quarter of Iliad’s entry. See Appendix B for results for Italy with the post-merger period lasting three, four or five years after the 2016 merger.

[16] Sourced from Compass Lexecon analysis of (i) retail revenues from mobile communications and data volume, call minutes, and text messages in the retail marked from Rundfunk und Telekom Regulierungs-GmbH (RTR) for Austria; (ii) total mobile retail revenues and voice, SMS, and other data volumes based on quarterly reports from the Commission for Communications Regulation (ComReg) for Ireland; (iii) retail external revenue from mobile services and mobile data volumes, SMS messages and call minutes from Bundesnetzagentur for Germany; (iv) recurring cellular revenue from GSMAi and data traffic from ACOM; (v) recurring cellular revenue from GSMAi and mobile data, minutes and SMS usage from Netherlands Authority for Consumers & Markets for the Netherlands; and (v) recurring cellular revenue from GSMAi and wireless data, minutes and text usage from CTIA for the USA.