Evaluating the potential price rise in partial acquisitions of ownership and control

Share

A firm sometimes acquires its rival partially, buying less than 100% of the rivals’ equity. In this article, Helder Vasconcelos [1] explores why a partial acquisition may incentivise a company to increase the prices of a firm by more than it would increase them after a full merger. In addition, he explains how the Gross Upward Pricing Pressure Index (GUPPI) can be adjusted to rigorously analyse the impact of partial acquisitions or divestments on competition.

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Introduction

Competition authorities often analyse potentially anti-competitive effects of “full” mergers and acquisitions, which completely and permanently eliminate competition between the merging parties. They also analyse “partial acquisitions”, where a firm acquires less than 100% of another firm’s equity.

Although partial acquisition does not entirely eliminate competition between firms, it can pose just as much threat to competition or consumers as a full merger of the same firms. It depends on the degree of ownership, and the degree of corporate control over prices. Indeed, when a firm acquires only a minor share of a rival’s profits, but controls its prices to a large extent, then it may have greater incentive to increase the rival’s prices after a partial acquisition than it would have after acquiring the entire firm.

This article explores how partial acquisitions affect the incentive to increase prices, and show how the Gross Upward Pricing Pressure Index (GUPPI) – which is a useful and common tool for analysing a firm’s incentive to raise prices after a full merger – can be adjusted to analyse the competitive effects of partial acquisitions (and divestments). This generalised GUPPI allows competition authorities to both analyse the potential impact a partial acquisition may have on prices, and also to assess and design adequate remedies.[2]

Partial acquisitions

Partial acquisitions are common in practice and competition authorities view these as needing scrutiny.[3]

The most common concern about these transactions relates to firms that partially acquire a rival in the same market, referred to as “cross-ownership”. Recent cases include:

- the acquisition by Ryanair of a 29.8% stake in Aer Lingus which the UK Competition Commission investigated, requiring Ryanair to sell its stake down to 5% in 2015;

- Amazon NV Investment Holdings (a wholly owned subsidiary of Amazon) acquiring a 16% shareholding in Roofoods (Deliveroo) – a transaction the CMA cleared on 4 August 2020

Authorities are also concerned about “common ownership” – where a firm external to the relevant market acquires partial stakes in multiple firms that compete with each other. An example from the US is the FTC inquiry into the Kinder Morgan buyout: where the private equity fund that sought to acquire the firm also held a significant share of Magellan Midstream, a major competitor of Kinder Morgan.[4] In addition, many US airlines and banks are linked both by cross-ownership of each other and by common ownership by the same shareholders. Both types of ownership are usually partial. Azar et al. (2018, 2022) conclude that the network of ownerships has anticompetitive effects. More broadly, in the US and other countries, major investment funds own appreciable shares in many large firms, which may be rivals. The network of ownerships within and across industries is potentially complex.

How does partial acquisition (or divestment) affect competition?

The effect of full mergers on a firm’s incentive to increase prices, due to a lessening of competition, has been comprehensively studied. Recently, studies have focussed on the impact that partial acquisitions can have on competition between firms with cross- or common ownership.[5]

The potential effect can be counterintuitive. Importantly, partial acquisitions don’t necessarily reduce the incentive to increase prices – that is, compared with a full merger between two competing firms, acquiring only half the equity won’t necessarily halve the incentive to increase the prices of the target of the acquisition. It may do so. But it can also amplify the incentive to increase prices.

The potentially anti-competitive effect of partial acquisition depends on how two factors interact:

- Partial ownership (i.e., the degree of financial interest in each firm). This means that an owner has the right to some proportion of the profit of the firm, not the whole profit. The usual reason is that the owner holds some but not all the equity in a firm.

- Partial control (i.e., the degree of corporate control over each firm). This means that an owner influences the decisions of the firm to some extent, but not exclusively. Other owners also have a say, which may be greater or lesser.

The degree of partial ownership is important as it affects an acquirer’s incentive to increase prices (i.e., its motive). A company will be fully exposed to the increase or decrease in the profits of the firms it fully owns. In contrast, partial ownership insulates the owner from those effects to some extent: it enjoys only a proportion of increased profits, and suffers only a proportion of reductions in profit. Before considering other factors, a common owner has a clear incentive to drive customers from a firm it owns only a partial stake in, to a firm that it owns a greater stake in, if it can.

The degree of partial control affects the acquirer’s ability to increase prices (i.e., its opportunity). The degree of control and ownership often align. If a firm owns a minimal proportion of a rival company, we might presume it has insufficient control to raise that rival’s prices. However, ownership and control can become decoupled in different ways. Examples include preferred or non-voting (silent) shares, clauses in the corporate charter, and reserved board seats. Even with a single share class and no special arrangements, the control one owner exerts depends on how fragmented the ownership is among the other owners. Holding 49% of shares may give no control if one other owner holds 51% of shares. If instead every other owner has less than 1% of the shares, then holding 10% may enable very significant control of the firm’s decisions.

For this reason, it is important that analysis of the potential anti-competitive effects of partial acquisition takes the degree of partial ownership and partial control into account as rigorously and quantifiably as possible. Below, we explore how to adjust GUPPI so that it accounts for ownership and control.

The gross upward pricing pressure index (GUPPI) in full mergers

We start by summarising the economic rationale behind GUPPI in the standard case of full acquisition, and then show how it can be adjusted for partial acquisitions (and divestments).

The rationale

When competition authorities assess whether a merger or acquisition between competitors (called a “horizontal merger”) would significantly lessen competition or cause consumer harm, they often assess a firm’s incentive to increase prices. Although lessening competition may harm consumers in other ways – reducing quality, choice, innovation or services – price increases are the most common form of harm and are the focus of many investigations, and this article.[6]

GUPPI is one of the various analytical methods economists use to measure the potential price impact of a merger.[7] It is a simple benchmark that expresses the percentage by which the merged entity would increase the prices of each firm in order to maximise its combined profits, assuming the competitors and the merger partner keep their pre-merger prices. The authority calculates a GUPPI for each merging firm, assuming that the products of each firm remain distinct after the merger.

In essence, GUPPI analyses how customers switching from one of the merged firms to the other would increase the prices at which the combined entity balances its profit margin and sales.

- Before the merger: Each firm separately chooses the optimal price to balance its own per-unit profit and quantities sold. At the optimal price, if the firm raised its price, then it would lose sales to rival firms, such that the decline in profits from lost sales more than offsets the increase in profits provided by higher margins on the remaining sales. Symmetrically, if the firm reduced its price from the optimal level, then the increased sales volume would be outweighed by the lower per-unit profit.

- After the merger: The merged firm chooses prices for each firm that optimise their combined profit. As before, raising the price of one of the firm’s products increases profits from retained customers, but loses customers for that particular firm. However, some of the customers who leave in response to the price increase switch to the acquired firm, so those sales are recaptured by the merged entity. Absent efficiencies, the merged entity is expected to set a higher price than the independent firms before the merger, because the benefit of raising the price is unaffected by the merger, but the cost of the price increase falls.

The GUPPI formula

In full mergers, the incentive to increase prices depends upon:

- the profitability of each firm’s products – in general, the merged entity has a greater incentive to increase the prices of a low-price firm, driving customers to a high margin firm; and

- the closeness of competition – in general, the more closely the firms’ products compete, the greater the proportion of switching customers the merged entity will retain.

To see how GUPPI analyses these effects, it is worth understanding the GUPPI formula.

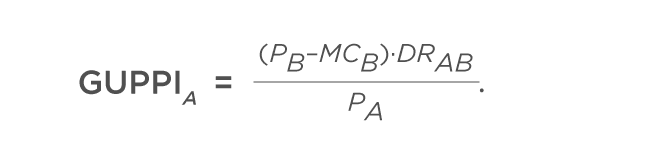

The basic GUPPI for a full merger of firms A and B is calculated as follows. For Firm A, multiply the profit per unit of Firm B’s product with the diversion ratio from firm A to B and divide by the price of Firm A’s product. If we denote the price of the product of firm B by PB and the marginal cost of producing it by MCB , so the profit per unit of the product is PB – MCB ; and denote the Diversion Ratio from Firm A to B as DRAB ; then:

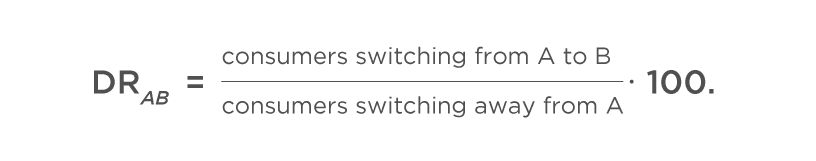

The diversion ratio from A to B is the share of consumers leaving A who end up buying from B. The formula for the diversion ratio divides the number of consumers switching from A to B by the total number of consumers leaving A after its price increase. The diversion ratio as a percentage is

The average variable cost is often used as a proxy for the marginal cost, because data on variable cost is usually easier to find.

The greater the GUPPI, the more likely a competition authority is to object to the merger, but the CMA explicitly rejects the use of numerical GUPPI thresholds to determine its decisions.[8]

The GUPPI formula in partial acquisitions

Although GUPPI is designed to analyse full mergers, it can be adapted to assess what impact a partial acquisition may have on competition.[9] In essence, we can express the upward pressure on prices taking into account the impact that partial ownership and control has on a firm’s incentive and ability to increase prices.

Suppose that firm A is acquiring a partial ownership stake in its competitor, firm B. As before, its incentive to increase prices, as indicated by its GUPPI, depends on the closeness of competition, and the profitability of each product. However, in the case of partial acquisition, it also depends on the extent to which Firm A partially owns and partially controls Firm B.

After partially acquiring its rival, Firm A still has some incentive to raise its own price, but less than it would have if it fully acquired Firm B. This is because it is fully exposed to the profits it loses from increasing the price of its own products, but – in contrast to a full merger – it does not receive the full benefit from the sales diverted to firm B.

This effect is quite standard. However, the impact that the partial acquisition has on the incentive of Firm A to increase Firm B’s price is quite different. That incentive decreases as Firm A’s ownership of Firm B increases. This is because firm A gets the full benefit of the customers switching from B to A, but only shares a proportion of the lost profits firm B suffers when it raises prices.

We also need to account for partial control. At the extreme, where the acquirer has no ownership share in the target firm but has complete control over its prices, the acquirer would raise the target firm’s price to a prohibitively high level. That would shut down the target, who is a competitor.

To put these factors into practice, Brito et al. (2018) generalise the GUPPI formula by including weights to analyse the impact partial ownership and partial control have. (The formula is explained in the appendix below).

Worked example

To see the impact that partial acquisition can have on incentives to increase prices, compare how the GUPPIs for a full merger differ from the GUPPIs for a partial acquisition in an otherwise identical situation.

A hypothetical airline market

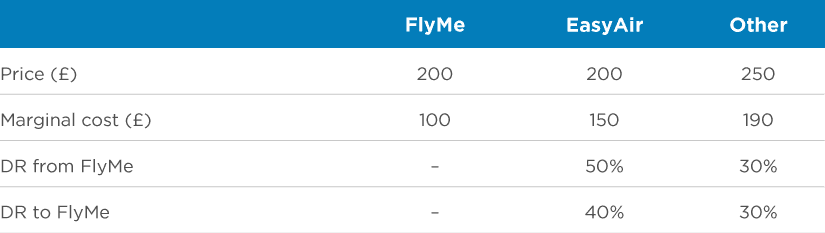

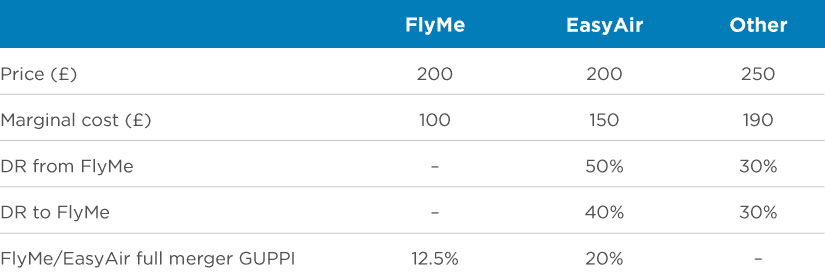

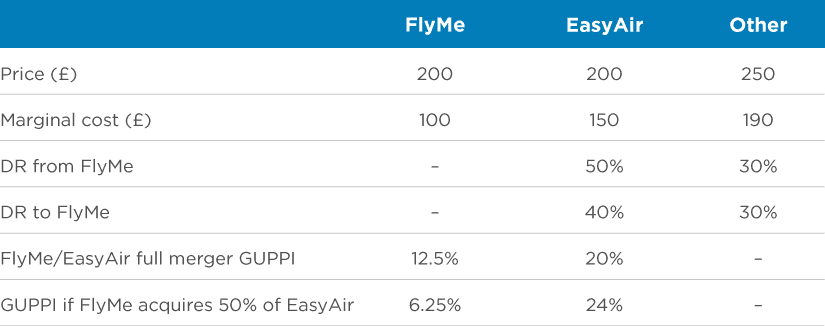

Suppose that there are two main airlines flying between London and Rome, and some small competitors. One airline, FlyMe, proposes to merge with its competitor, EasyAir. To assess whether the owner would increase prices for either airline after the acquisition, the competition authority collects the following information on prices, costs and diversion ratios.

Scenario 1: The basic GUPPI for a full merger

In the first scenario, suppose that FlyMe fully merges with EasyAir. The owner of the merged firm has full control over it. The calculations in the Appendix show the resulting FlyMe GUPPI is 12.5%, which a competition authority would typically consider significant upward pricing pressure, absent synergies. This is consistent with FlyMe and EasyAir being close substitutes. The GUPPI for EasyAir is 20%, significantly larger than for FlyMe, because the profit margin of FlyMe is double that of EasyAir, and their prices are equal. The lower diversion ratio to FlyMe than to EasyAir somewhat counteracts the effect of the profit margin. The GUPPI values are shown in the table below. If the merger does not reduce marginal costs for either firm, and competition is on price, then the GUPPIs are lower bounds on the price effects of the merger.

The partial acquisition GUPPI

In the second scenario, suppose that, rather than a full merger, the sole owner of FlyMe seeks to acquire a 50% stake in EasyAir’s profits, and 60% of EasyAir’s corporate control. The initial owner of EasyAir retains 50% of ownership and 40% of control, and the other firms remain independent.

Intuitively, the owner has an incentive to increase FlyMe’s prices; its GUPPI is 6.25% (see the Appendix). That incentive is half the level it would be if the owner had fully acquired Easy Air. For every customer that switches to EasyAir, FlyMe suffers the same loss from its own sales in both scenarios, but its partial ownership of EasyAir captures only half of the benefit of customers switching to EasyAir.

However, the owner’s incentive and ability to increase EasyAir’s prices is greater than it would have been had it fully acquired it – the GUPPI of EasyAir is 24%, higher than it would have been after a full merger, where the GUPPI would be 20%. The partial acquisition of EasyAir creates more upward pressure on prices than a full merger would have done, because the sole owner of FlyMe acquires more control of EasyAir than ownership.[10]

Benefits of applying GUPPI to partial acquisition, divestments, and revenue sharing agreements

The same basic approach can be used to consider other changes in ownership and control, including (partial) divestments.[11] Divestments will usually create downward pricing pressure for the divesting firm, meaning that the GUPPI is negative. However, it is possible for ownership and control to change such that divestment leads to increased rather than decreased pricing pressure, for instance if a firm retains high levels of control while reducing its profit share. Clarity on these issues is crucial, not just for assessing the potential anti-competitive effects of partial acquisitions, but also to assess the potential efficacy of divestment strategies when developing structural remedies in mergers.

An example in which divestment may backfire is reducing ownership more than control, starting from full ownership and control. Suppose the owner of FlyMe initially also fully owns EasyAir, then divests to 50% of ownership and 60% of control. For this partial divestment, the GUPPI of EasyAir is positive: 4%. The divestment increases EasyAir’s prices, because after the divestment, the owner of FlyMe loses less profit on each customer leaving EasyAir, but the profit on each customer coming to FlyMe remains the same. The owner of FlyMe has an incentive to motivate the management of EasyAir to raise prices, in order to send some of its customers to FlyMe.

The approach can also be extended to situations where platform firms take a percentage of a seller’s revenues rather than profits, as is common with online marketplaces and app stores. The GUPPI formula is simplified in the case of revenue shares, as only prices are needed, rather than prices minus marginal cost (Hervas-Drane and Shelegia 2022). The precise formula is at the end of the Appendix. The GUPPI for a revenue share is larger in magnitude than that for a profit share, because the revenue per unit is greater than the profit per unit. In particular, the GUPPI for a divestment of equal ownership and control by equal amounts is more negative – price falls more under a revenue sharing agreement than it would under profit sharing. Structural remedies may be more effective for platforms that take a share of the sellers’ revenues than for standard (partial) acquisitions.

Summary

The generalised upward pricing pressure index approach has long been used by competition authorities assessing the likely effects of mergers.[12] This article illustrates how it can be extended practically and straightforwardly to partial acquisitions (and to divestments), which are an increasing focus of competition authorities. The results are sometimes counterintuitive. In particular, if an acquiring firm gains more control than ownership, then upward pricing pressure can be higher than in a full merger, while it can be lower if the control stake is lower than the ownership stake.

Read all articles from this edition of the Analysis

View the PDF version of this article

[1] Helder Vasconcelos is a Senior Vice President at Compass Lexecon. The views expressed in this article are the views of the author only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

[2] This article summarises the findings of Brito, Duarte and Osório Costa, António Miguel and Ribeiro, Ricardo and Vasconcelos, Helder, Unilateral Effects Screens for Partial Horizontal Acquisitions: The Generalized HHI and GUPPI (March 1, 2018). International Journal of Industrial Organization, Vol. 59, 2018, Available at SSRN here or DOI here.

[3] U.S. Department of Justice and U.S. Federal Trade Commission, Horizontal Merger Guidelines (2010), Section 13. OFT, Minority Interests in Competitors, A Research Report prepared by DotEcon Ltd (2010). OECD, Antitrust Issues Involving Minority Shareholdings and Interlocking Directorates, DAF/COMP(2008)30.

[4] “FTC Challenges Acquisition of Interests in Kinder Morgan, Inc. by The Carlyle Group and Riverstone Holdings”, Federal Trade Commission, 25 Jan 2007.

[5] Salop and O’Brien (2000), Farrell and Shapiro (2010), Brito et al. (2018) and the references therein.

[6] The economic principles of measuring the harm and the countervailing efficiencies from the merger are set out in the EC Guidelines on the assessment of horizontal mergers Section IV, the CMA Merger Assessment Guidelines Section 4 and the US Horizontal Merger Guidelines Section 6.1.

[7] The upward pricing pressure index was originally proposed in Salop and O’Brien (2000). The implications of partial ownership for competition were studied in Reynolds and Snapp (1986).

[8] CMA Revised Merger Assessment Guidelines 2021 para 2.139.

[9] Brito et al. (2018) generalise the formula to include the price effects of any pattern of common owners and cross-ownership among firms, which we outline in the Appendix.

[10] “Can Partial Horizontal Ownership Lessen Competition More Than a Monopoly?” (Duarte Brito, Ricardo Ribeiro and Helder Vasconcelos), Economics Letters, Vol. 176, March 2019, pp.90-95.

[11] See Brito et al. (2018) for more details.

[12] U.S. Department of Justice and U.S. Federal Trade Commission, Horizontal Merger Guidelines (2010).