Is the threat of retaliation by customers an economically sound defence to input foreclosure?

Share

In practice, the threat that a victim of input foreclosure may retaliate can deter a merged entity from pursuing a foreclosure strategy against competitors. However, retaliatory strategies can be strange from an economic standpoint. In this article, Christopher Milde and Oliver März [1] explore this puzzle, examining why firms retaliate, how the European Commission considers retaliation strategies, and how the threat and impact of retaliation can be integrated into merger assessments.

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Introduction

When advising companies on a vertical merger, companies often consider concerns of input foreclosure unwarranted because they think that their customers would “hit back at them”, i.e. retaliate in response to any foreclosure attempt. Retaliation is possible if foreclosed customers also purchase other inputs from the upstream entity in markets that cannot be foreclosed. Retaliation therefore can deter input foreclosure, if the threat of customers reducing or eliminating their purchases of such other inputs from the merged entity could result in losses that would turn an otherwise profitable foreclosure strategy unprofitable.

It is increasingly common for competition authorities to take retaliation into account when assessing input foreclosure. From an economic perspective, however, retaliation is puzzling. The fact that the “victim” of input foreclosure has chosen the merged entity as a supplier in the non-affected market reveals that the merged entity had the most competitive offering in that market. Foreclosure – by definition – does not change conditions in the non-affected market. So, retaliation would require the “victim” to switch to an inferior offering, hurting its own profits. This could undermine the credibility of any threat of retaliation and render it ineffective as a compelling defence.

We shed light on this puzzle by looking at potential reasons that may explain why firms facing a threat of input foreclosure could adopt retaliatory strategies. We then document how the European Commission (“EC”) has taken retaliation into account, and conclude by illustrating that it is straightforward to incorporate retaliation into the standard analysis of foreclosure incentives.

Explaining retaliation

To illustrate how input foreclosure and retaliation work, we consider the following working example:

- Firm U operates in the upstream market, and it produces inputs A and B.

- Firm D operates in a downstream market where it uses input A, supplied by Firm U, to manufacture products for the final customers.

- Firm R operates in the same downstream market where it purchases input A from Firm U and uses it to manufacture a product that competes with Firm D. However, it also purchases input B from Firm U, which it uses to manufacture a product that may or may not compete with Firm D.

Figure 1 below illustrates this setup. The upper panel illustrates the situation before the merger. Both Firms D and R are vertically linked to Firm U via the purchases of input A, and the two firms compete against each other downstream. However, Firm R is also vertically linked to Firm U by its purchases of input B. By choosing to purchase input B from Firm U, Firm R reveals that having Firm U as their supplier is the best, profit-maximising choice that is available, meaning that Firm U is able to supply input B at either a higher quality or a lower price, or at both, than its rivals.

The lower panel illustrates the situation after the merger between Firms U and D. Firm U forecloses Firm R from input A by increasing the price for it. Meanwhile, the conditions for supplying input B remain unchanged. Purchasing input B from the merged entity should therefore still be profit-maximising for Firm R, even though the merged entity is foreclosing Firm R from input A. Switching the supplier of input B would be costly for Firm R because it would have to purchase products that are more expensive or of lower quality.

Figure 1: Input foreclosure of input A and retaliation on input B

Retaliation would likely reduce the profit of Firm R, which violates the standard assumption that firms are rational and maximise profits. Because of this violation, the merged entity may not consider the threat of retaliation as credible. Consequently, a retaliatory strategy by Firm R may be ineffective for deterring the merged entity from engaging in input foreclosure.

Why then does retaliation occur, and how could it be credible in practice? Below, we discuss three potential circumstances where this could be the case.

Reason 1: Indifference between suppliers

In some cases the customers of the merged entity may be largely indifferent to which supplier of input B to rely on. For example, if switching costs are negligible and alternative suppliers offer goods of similar quality, price and/or conditions to the merged entity, customers would not be worse off when switching to upstream rivals. This does not necessarily mean that different suppliers need to offer the same prices or quality, but rather that customers are indifferent when comparing the whole price, quality, range and service (PQRS) offering of different suppliers. In this case, retaliation would not affect the “victim’s” profits and it could credibly threaten to retaliate in the event of foreclosure.

However, in this case the merged entity’s potential losses from retaliation are likely small. When customers are indifferent between two input suppliers and switching costs are minimal, it is unlikely that profit margins from selling such inputs are high. Accordingly the merged entity would not lose high profit margins from the retaliation. This decreases the likelihood of successfully deterring the merged entity from engaging in input foreclosure.

Reason 2: Repeated interactions

Retaliation can also be rational if the “victim” considers how the action it takes today affects how the merged entity will act in the future. Even if retaliation results in lower profits for the “victim” in the short run, demonstrating a willingness to retaliate could prevent the merged entity from further input foreclosure in the future, for example by further increasing the price for input A or by also foreclosing input B in a future merger. In this case, acting tough by sacrificing profits today can save the “victim” from having to incur further, larger losses in the future.[2]

This rationale requires continuing repeated interactions between the merged entity and the “victim” of the foreclosure strategy. If there are no or few future interactions between the merged entity and the “victim”, then the potential long-term benefits from retaliation are likely so small that the “victim” will not find it worth to sacrifice profits in the short run. As a consequence, in this case, retaliation would not be credible.

Reason 3: Behavioural explanations

Firms are managed by people, and the choices of these people may not be aligned with the objective of maximising the short- or long-term profits of the firm. Therefore, retaliation may simply reflect the non-aligned behaviour of the people managing the firm, as opposed to the pure profit-maximising strategy for the firm.

This potential explanation can be supported by the literature on behavioural economics. For example, Rabin (1993) argues that people care about fairness and/or reciprocity when interacting with others, as opposed to strictly rationally maximising their own material wellbeing.[3] In other words, people will treat those people well who treat them well. Conversely, if people feel they are being treated unfairly, they may punish this unfair behaviour even if it is not in their own best self-interest to do so.

Such reciprocal behaviour has been elicited in numerous economic studies and it has been found to be a powerful explanation of human behaviour.[4] Evidence also suggests that reciprocal behaviour tends to be asymmetric, as the propensity to punish harmful behaviour is stronger than the propensity to reward friendly behaviour.[5]

In this case, the managers of the “victim” firm choose to punish the merged entity for treating them unfairly, and do so by purchasing inputs from the upstream rivals instead, even if it is not in the best interest of the firm to do so. Unlike in the previous case, this behaviour will not be profit-maximising to the firm even in the long run, and hence it is irrational from a pure profit-maximising perspective. Nevertheless, retaliation is credible in this case.

The EC takes retaliation into account

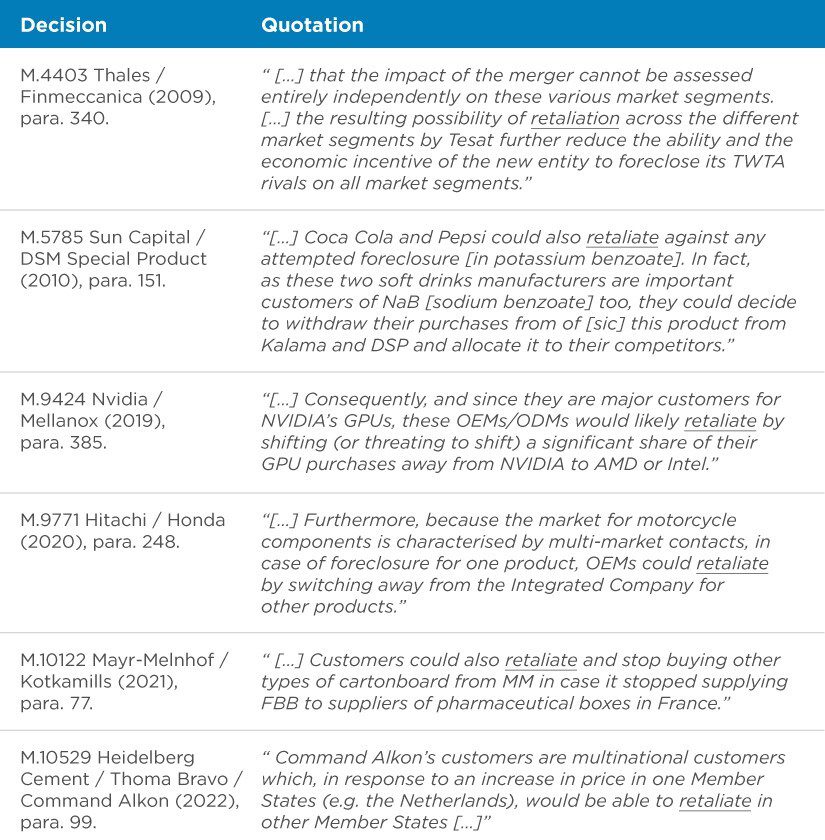

Irrespective of its underlying rationale, retaliation has been considered credible by the EC, as it has taken the threat of retaliation into account in its decisions. This is illustrated in Table 1 below which lists quotations from several recent decisions by the EC in which it has considered retaliation when assessing the risk of input foreclosure.

Table 1: Retaliation strategies considered by the EC

It is clear from these quotations that the EC considers the threat of retaliation in other product or geographic markets a relevant factor when assessing the risk of input foreclosure and, in particular, when analysing the incentive of the merged entity to carry out an input foreclosure strategy.

In the following section we discuss how retaliation can be taken into account in the incentive analysis.

Considering retaliation in an incentives analysis

Analysing the incentive to foreclose typically requires comparing profit losses due to foreclosure in the upstream market with corresponding profit gains in the downstream market.[6] The challenge with this approach is that it requires modelling the various possible foreclosure strategies, as well as how the foreclosed downstream rivals and final customers would react to these strategies. This adds complexity to the standard incentive analysis.

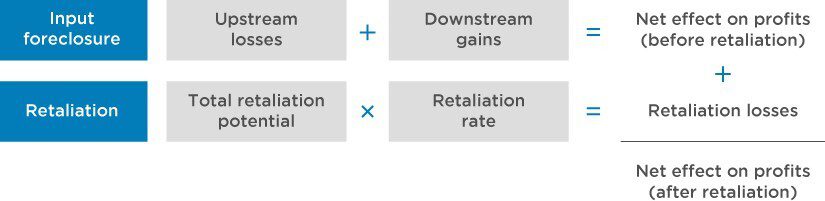

Fortunately, incorporating retaliation into the incentives analysis is relatively simple. This is due to the fact that retaliation – by definition – occurs in a market that is unaffected by the input foreclosure, and hence it can be analysed separately from the direct effects of the foreclosure strategy. It is then sufficient to simply “add” the impact of retaliation to the comparison of gains and losses in the affected market. This is illustrated in Figure 2 below.

Figure 2: Retaliation in an input foreclosure analysis

In practice, there are four steps to the retaliation analysis, each of them described below.

Step 1: Assessing the total retaliation potential

Retaliation analysis starts with assessing the total retaliation potential. The retaliation potential constitutes the profits which the upstream unit of the merged entity receives from the sale of inputs to downstream rivals in markets not affected by the potential foreclosure strategy.

Using the earlier example, the retaliation potential of the merged entity are the profits Firm U makes from selling input B to the downstream rival Firm R.

Step 2: Assessing the retaliation rate

Once we know the total retaliation potential we can assess the “retaliation rate”. This is the share of the total retaliation potential that is likely to be used for retaliation by the foreclosed downstream rivals.

Different factors can limit the ability of the downstream rivals to retaliate and thus reduce the retaliation rate. These factors may include:[7]

- high costs of switching to alternative suppliers;

- few alternative suppliers who could offer products at similar levels of price or quality; or

- supply restrictions of alternative suppliers such as capacity constraints.

Evidence of such barriers to retaliation may be found from past switching behaviour of the downstream rivals. For example, customers of the upstream unit of the merged entity may have already retaliated in the past in response to price increases or equivalent deteriorations in supply conditions. In this case it may be possible to obtain a plausible estimate of the retaliation rate.

Step 3: Calculating the retaliation losses

Once both the retaliation potential and the retaliation rate have been established, they are multiplied to obtain the retaliation losses. These are the loss of profit to the merged entity that can be attributed to the retaliation.

How the retaliation potential and the retaliation rate interact is important and subtle; they are likely to be negatively correlated. Customers are likely to retaliate when the barriers to switching are low, yet this also implies that the margins from the sales subject to retaliation are likely to be lower than in a case where barriers to switching are high and customers are less likely to retaliate.

Step 4: Calculating the effect of retaliation losses on net profits

As a final step, the retaliation losses are added to the net profits from the foreclosure strategy before retaliation.

In the case that the net profits are found to be positive, the threat of retaliation will not deter input foreclosure as the potential benefit of the foreclosure strategy outweighs the negative response.

However, if the net effect on profits of the foreclosure strategy and the retaliation is negative, then the threat of retaliation losses deters input foreclosure – as retaliation would turn the strategy from profitable to unprofitable. As a result, the merging parties may not have the incentive to foreclose downstream rivals due to the threat of retaliation.[8]

View the PDF version of this article.

References

-

Christopher Milde is a Senior Vice President at Compass Lexecon. Oliver März is a Senior Economist at Compass Lexecon. The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

-

In particular, retaliation could be framed as an application of the taxonomy described in Tirole (1988), “The theory of industrial organization”, MIT Press, Chapter 8.3-8.4, in which firms take specific actions prior to future competition to be considered tough or soft by their rivals.

-

Rabin (1993), “Incorporating Fairness into Game Theory and Economics”, American Economic Review, 83 (5), pp. 1281-1302.

-

See e.g. Fehr & Gächter (2000), “Fairness and Retaliation: The Economics of Reciprocity”, Journal of Economic Perspectives, 14 (3), pp. 159-181, offer a survey of the literature.

-

Fehr & Gächter (2000), supra, p. 162.

-

See Guidelines on the assessment of non-horizontal mergers under the Council Regulation on the control of concentrations between undertakings (“NHMG”), 2008/C 265/07, para. 40.

-

These factors are similar to those typically considered when assessing the ability of the merged entity to foreclose inputs. See NHMG, paras. 33-39.

-

Alternatively, it is possible to calculate a “critical retaliation rate” at which the retaliation losses turn the input foreclosure strategy from being positive to becoming negative. Depending on the characteristics of the specific case, the likelihood that the critical retaliation rate will be surpassed then needs to be assessed.