Market definition in principle and practice

Share

How should market definition be applied in competition decisions? In light of the European Commission’s ongoing review of its Market Definition Notice and similar developments in the US and UK, Joe Perkins sets out how the process is meant to work, how it actually works, and the lessons we can learn from understanding the gap between the two.

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Developments in the concept of market definition

Market definition has been at the cornerstone of antitrust decision-making for decades, dating back at least to Adelman (1959).[2] Although this might seem intuitive – to assess a firm’s market power, surely one needs to identify the market it has power over – the process has often been met with skepticism by economists. In particular, this is because a firm’s share of a market and its market power are not clearly related. A market with only two firms could exhibit aggressive price competition, while a market with many firms could be a hotbed of tacit collusion. Kaplow (2010) argues that “the market definition process is incoherent as a matter of basic economic principles and hence should be abandoned entirely”.[3]

However, economists’ attacks on market definition have had limited traction. Defining a market is often useful. It helps to: (a) focus the scope of analysis and debate; (b) create a ‘safe harbor’ for mergers and behavior that are unlikely to harm consumers, meaning that companies can be confident they will not be prohibited; and (c) increase the transparency of decision-making.

Recent developments in three major jurisdictions have focussed attention on the concept of market definition and raised questions about how it might be applied in the future:

- In 2020, the European Commission launched a consultation on its Market Definition Notice, which dates back to 1997. It published a staff working document summarising the findings of its evaluation in July 2021, concluding that the Notice remains relevant, but that it does not fully reflect developments in best practice and case law.[4]

- In the US, the tenth anniversary of the current Horizontal Merger Guidelines in 2020 prompted lively debate about their continued relevance, including a special issue of the Review of Industrial Organization published in January 2021.[5] While there is as yet no firm consensus over whether or how they should be revised, the debate identified an apparent gap in practice between agencies and courts, with the latter placing significantly greater weight on formal market definition than agencies, which often focus on direct evidence of the effects of a merger on head-to-head competition.[6]

- In the UK, the Competition and Markets Authority consulted on revisions to its merger assessment guidelines in November 2020 and issued revised guidance in March 2021. Relative to the previous 2010 guidelines, the CMA now downplays the role of what it terms ‘static’ market definition, stating that it anticipates that, in the future “merger assessments will place more emphasis on the competitive assessment as opposed to static market definition.”[7] Beyond any specific changes, the CMA’s presentational shift is marked; in 2010, market definition was at the center of the guidance and took up over 4000 words. Now, it is relegated to the end, covered in fewer than 1700 words.

Does the process of market definition need to change? Would changing it lead to better competition decisions? Before trying to answer these questions, it helps to understand how market definition is currently applied. In this article, we set out how the process of market definition is meant to work – as described in competition authorities’ own guidelines – how it actually works in practice, and what lessons we might learn from the gap between the two.

The gap between theory and practice

For at least the last two decades, there has been a rigorous and widely accepted approach to defining markets for antitrust purposes, based around the hypothetical monopolist test. For instance, the FTC-DoJ 2010 Horizontal Merger Guidelines state that:

The hypothetical monopolist test requires that a product market contain enough substitute products so that it could be subject to post-merger exercise of market power significantly exceeding that existing absent the merger. Specifically, the test requires that a hypothetical profit-maximizing firm, not subject to price regulation, that was the only present and future seller of those products (hypothetical monopolist) likely would impose at least a small but significant and non-transitory increase in price (SSNIP) on at least one product in the market, including at least one product sold by one of the merging firms.

Essentially, if a price rise would not convey any advantage, even to a monopolist, there is no market power available and so no scope for a merger in this market to harm consumers.

The European Commission’s 1997 Notice on the definition of relevant market is less specific, viewing the hypothetical monopolist test as ‘one way’ of defining a market. However, no other way is described, suggesting again that the hypothetical monopolist test is at the core of market definition.

Economists have proposed few practical alternatives to the hypothetical monopolist test, none of which has gained widespread acceptance.[8] There are of course nuances around, for instance, market definition in the context of two-sided or dynamic markets, as well as the well-known ‘Cellophane Fallacy’,[9] but these do not undermine the basic approach.

However, the reality of market definition rarely matches this theory. In 2007, Dennis Carlton concluded that in the US:

The procedure for defining a market in a merger case or Section 2 case can be rigorously described, but the information required to implement the procedure is typically unavailable. Few analysts (or courts) follow the rigorous procedure in either merger or Section 2 cases. Instead, most markets are defined with some guidance from theory and some qualitative knowledge.[10]

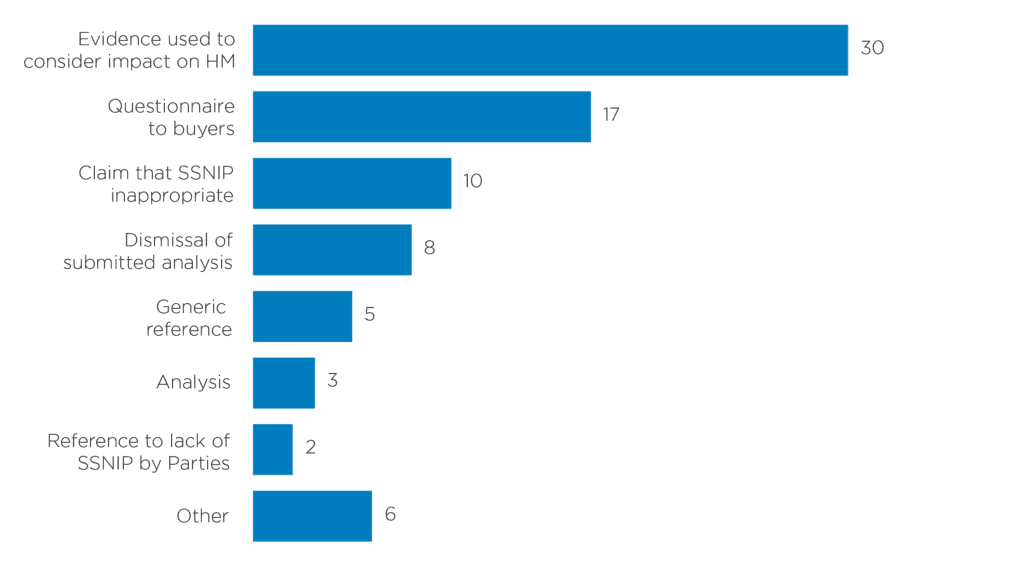

The situation has not changed significantly since. There are 3,034 European Commission merger decisions published in English on the EC competition case search website covering the period between 1990 and 2019.[11] Only 81 of them (2.7 percent) mentioned a hypothetical monopolist, a SSNIP test, or critical loss analysis at all.[12] Of these, only 20 carried out economic analysis of the impact of a small but significant non-transitory increase in price (SSNIP), principally through customer questionnaires (Figure 1). The rarity of rigorous SSNIP analysis was recognized in the Commission’s recent Staff Working Document, which stated that, while the SSNIP test often guides the analytical approach, “the Commission has rarely applied the SSNIP test empirically.”[13]

Figure 1: Approaches taken in the 81 merger cases that mention a hypothetical monopolist, SSNIP test, or critical loss analysis

Source: Compass Lexecon analysis of all European Commission (EC) merger decisions between 1990 and 2020 published in English on the EC website here.

We have also analyzed recent merger decisions by the UK Competition and Markets Authority, which show more active consideration of the SSNIP test concept. Of the 482 published merger cases since 2010, 108 (22.4 percent) mentioned a hypothetical monopolist, a SSNIP test, or critical loss analysis. Of these, 83 implement an SSNIP test, 62 of them through a conceptual discussion of the available evidence, 20 through issuing questionnaires based on the SSNIP test concept to buyers, and four through conducting quantitative analysis, such as a critical loss calculation or estimation.[14]

Why principle and practice do not match

Given the clear guidance on how market definition should be carried out, why is there such a gap between principle and practice?

First, and most obviously, the information required to carry out a rigorous SSNIP test is often unavailable, particularly at Phase I of a merger decision.[15] Moreover, where such information is available, it may be more straightforward to determine market power by estimating mark-ups, rather than to be particularly concerned with market definition itself.[16]

While this argument has some validity, the evidence presented above suggests that it is rare that a case even discusses the reasons for not carrying out a SSNIP test. And, where information is lacking, there are likely still benefits in outlining the logic involved in reaching a particular market definition, and how it aligns to a hypothetical monopolist test. For instance, in the Topps case – which concerned alleged anti-competitive practices in relation to collectible football stickers and trading cards – the Commission noted that “there may be some degree of substitutability between sport-themed and entertainment collectibles”.[17] This is true, but there may also be some degree of substitutability between beds and cars; the logic of the hypothetical monopolist test enables systematic consideration of the extent of substitutability that is consistent with a particular market definition.

A second argument is that the definition of a market is in many cases non-contentious or obvious. And clearly defining a market is much more straightforward in some cases than in others. However, because rigorous approaches to market definition are only carried out infrequently, it is hard to be confident that apparently obvious results would remain so following a thorough assessment. For instance, price discrimination might be naively assumed to suggest separate markets. But when there are quantity discounts or other forms of non-linear pricing, each price on a menu is constrained by every other price – if a firm charges less for the first unit it sells, it might have to charge less for each subsequent unit too. Moreover, a focus on whether a particular definition is ‘non-contentious’ relies on the competence and motivation of the parties involved.

Third, the resources and capabilities of competition authorities vary widely, and sometimes may be insufficient to carry out market definition exercises rigorously. Limited resourcing can lead to reliance on the evidence submitted by merging parties, with limited investigation by the authorities themselves. The high bar set by the courts for the use of quantitative evidence may also encourage the use of qualitative analysis instead, militating against a rigorous approach.

There are also concerns, particularly in the US, that SSNIP-test approaches can lead to implausibly narrow market definitions that do not accord with a common sense appraisal, and which tend to exclude wider efficiencies. Such a concern can perhaps be seen in the recent judgment on Epic Games v. Apple, where the court ruled out the possibility of a single-firm app store as a relevant market and instead defined a market across digital gaming transactions on mobile phones.[18]

Finally, a reluctance to carry out rigorous approaches to market definition in practice may reflect a desire by competition authorities to maintain and enhance their scope for discretion. Although authorities are well-intentioned in establishing guidelines, they may be less keen to apply them consistently and thoroughly in practice.

Why the gap between principle and practice matters

The lack of a consistent and rigorous approach to market definition can lead to poor decision-making in merger cases, with, for instance, beneficial mergers being prohibited, or harmful mergers being allowed. But even without such extreme impacts, the potential benefits of market definition are severely undermined by the use of ad hoc approaches.

For instance, inconsistent application means that there are few if any ‘safe harbor’ benefits. Firms cannot be confident about how the markets they operate in will be defined, meaning they cannot be confident about whether a proposed merger is likely to be permitted, or whether their actions will lead to an antitrust investigation. Transparency and accountability are harmed by the divergence between the stated approach of competition authorities and the way they consider market definition in reality. Moreover, the role of market definition in focussing analysis is of little benefit if it leads to a concentration of attention on the wrong questions or causes authorities to overlook important issues that are outside the scope of the defined market.[19]

Ad hoc approaches to market definition enable authorities to define markets on the basis of their judgement of the factors involved. Sometimes, this could be beneficial, allowing decisions to reflect the specific circumstances of a market more closely. But it can also be harmful, leading decisions to be based on preconceived ideas or incoherent reasoning and resulting in inconsistent approaches across similar cases.[20]

What we should learn from current practice

There are interesting developments in both theory and practice at authorities and in academia, including the construction of a quality-based analogue to the SSNIP test for zero-price markets.[21] But there is as yet no firm resting place for the concept of market definition, and substantial evolution is likely in coming years. In particular, while the CMA’s emphasis on dynamic competitive effects is welcome, its lack of a clear analytical framework could lead to an ‘anything goes’ approach, whereby the authority’s discretion means that the potential ‘safe harbor’ benefits of a well-established methodology are lost.

In this context, we propose three key changes that are needed to gain the benefits available from defining markets in merger cases.

First, principle and practice need to be aligned.

- The chasm between the two means that the benefits that could result from predictability and transparency are squandered; indeed, current guidelines may be counter-productive in outlining an approach that is not enacted in reality.

- We would suggest that the hypothetical monopolist test remains a valuable organizing principle for such an alignment. Decisions should describe systematically how they have followed the conceptual steps of the test, even where, as will frequently be the case, it is not possible to assess them quantitatively. Bishop and Walker’s 2010 statement remains highly relevant: “defining relevant markets on a basis that is not consistent with the principles of the Hypothetical Monopolist Test will, almost by definition, fail to take properly into account demand-side and supply-side substitution possibilities.”

Second, where qualitative methods are used in market definition, they should be applied rigorously and consistently.

- It is striking that, while authorities often provide guidance on how economic evidence should be submitted[22] (and such evidence is frequently challenged by the authorities and by other parties), there is little guidance on how qualitative evidence should be used. As a result, authorities are open to charges of cherry-picking – finding qualitative evidence that matches their preconceived ideas of a market. There are substantial opportunities to improve the quality and rigor of decision-making in antitrust cases by drawing on long-standing approaches in other disciplines, particularly the medical profession.[23]

Third, and perhaps most important, authorities should recognize the limits of market definition.

- Even with a more rigorous and consistent approach, market definition will not be an exact science – there will always be judgement involved in whether a product should or should not be included. However, authorities frequently overlook this fact once markets have been defined, treating the classification as fixed forever, rather than as a useful rule of thumb. The statement in the CMA’s revised merger assessment guidelines that “while market definition can sometimes be a useful tool, it is not an end in itself” is helpful in this regard, focussing on the purpose of market definition rather than the process.[24]

- This means, in particular, that evidence from nearby markets may still be relevant to merger assessment; indeed, as Glasner and Sullivan (2020) suggest, different market definitions may be relevant to different aspects of a case.[25] Moreover, since markets are typically defined based on demand-side substitution possibilities, it is important to continue to consider the possibilities of supply-side substitution as casework continues.

In conclusion, there is a clear need for further work to understand the implications of different business models, and of competition on grounds other than price, particularly in digital markets. Developing approaches to market definition that better reflect dynamic and uncertain markets will be part of this process – but this should not be at the expense of abandoning the basic logic of market definition entirely.

View the PDF version of this article.

[1] The views expressed in this article are the views of the author only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees, or its clients. This article is based upon Jorge Padilla, Joe Perkins and Salvatore Piccolo's‘ Market definition in merger control revisited’, in Ioannis Kokkoris (ed) Research Handbook in Competition Enforcement (forthcoming), Edward Elgar.

[2] M. A. Adelman, ‘Economic Aspects of the Bethlehem Opinion’ (1959), Virginia Law Review.

[3] Louis Kaplow, ‘Why (Ever) Define Markets?’ (2010), Harvard Law Review.

[4] European Commission, Evaluation of the Commission Notice on the definition of relevant market for the purposes of Community competition law of 9 December 1997 (12 July 2021).

[5] Joseph Farrell and Carl Shapiro, ‘The 2010 Horizontal Merger Guidelines after 10 Years’ (2021), Review of Industrial Organization, January 2021.

[6] Alison Oldale, Joel Schrag and Christopher Taylor, ‘The 2010 Horizontal Merger Guidelines at Ten: A View from the FTC’s Bureau of Economics’ (2021), Review of Industrial Organization, January 2021.

[7] Competition and Markets Authority, Merger Assessment Guidelines (2021), paragraph 9.2.

[8] The main quantitative alternative is to analyze the relationship between prices of products in the candidate market for market definition and prices of products outside that market. If these prices are closely related, this is prima facie evidence that the products are part of the same market. See Robert O’Donoghue and Jorge Padilla, The Law and Economics of Article 102 TFEU (Hart Publishing, 3rd edn, 2020) for more detailed discussion.

[9] The Cellophane Fallacy, dating back to a US antitrust case against DuPont in the early 1950s, is an error based on defining markets according to a firm’s ability to increase prices relative to potentially monopolistic actual prices, rather than relative to a counterfactual competitive price level. Though this is an important consideration to bear in mind, there are several ways of avoiding the fallacy in practice.

[10] Dennis Carlton, ‘Market Definition: Use and Abuse’ (2007), Competition Policy International, Vol. 3, No. 1, p.27.

[11] Analysis conducted by data scientists at Compass Lexecon. For more details of the methodology adopted, see Rashid Muhamedrahimov and Andrew Tuffin, ‘Analysing EC merger decisions’ (2021).

[12] Specifically, the analysis involved searching through the text of merger decisions and identifying all uses of the terms “SSNIP”, “small but significant non-transitory increase in price”, “critical loss”, and “hypothetical monopolist”. We looked only at cases where the EC’s simplified procedure was not applied; there are around 4000 further cases where the simplified procedure was followed.

[13] European Commission, Evaluation of the Commission Notice on the definition of relevant market for the purposes of Community competition law of 9 December 1997 (12 July 2021), p.38.

[14] These are not mutually exclusive. For instance, a SSNIP test questionnaire may be considered as one piece of evidence among others, such as internal documents and price correlation studies.

[15] The European Commission is much more likely to mention a SSNIP test or related terms in phase II cases than in phase 1 cases; around 17 percent of phase II cases discuss a SSNIP test, compared to just over 1 per cent of phase I cases.

[16] See, for instance, Einav and Levin, ‘Empirical Industrial Organization: A Progress Report’ (2010), Journal of Economic Perspectives.

[17] Case AT.39899 - Licensing of IPRs for football collectibles.

[18] Epic Games v. Apple, Case 4:20-cv-05640-YGR, Document 812 (N.D.Cal 2021).

[19] David Glasner and Sean Sullivan, ‘The logic of market definition’ (2020), Antitrust Law Journal discusses some of the flawed reasoning on market definition that they perceive in US cases.

[20] Nicolas Petit, ‘How much discretion do, and should, competition authorities enjoy in the course of their enforcement activities? A multi-jurisdictional assessment’ (2010), Concurrences discusses several aspects of discretion in competition authority decision-making.

[21] See OECD, ‘The role and measurement of quality in competition analysis’ (2013).

[22] For instance, see DG Competition, Best Practices for the Submission of Economic Evidence and Data Collection in Cases concerning the Application of Articles 101 and 102 TFEU and in Merger Cases, available at https://ec.europa.eu/competition/antitrust/legislation/best_practices_submission_en.pdf accessed 8 April 2021.

[23] For instance, Nicholas Mays and Catherine Pope, ‘Qualitative Research: rigour and qualitative research’ (1995), BMJ.

[24] Competition and Markets Authority, Merger Assessment Guidelines (2021), paragraph 9.4.

[25] David Glasner and Sean Sullivan, ‘The logic of market definition’ (2020), Antitrust Law Journal, p.34.