Multi-jurisdictional merger control accounting for decisional errors

Share

Divergent decisions in multi-jurisdictional merger reviews have led to an ongoing debate about their impact and whether policies such as cooperation and comity between competition authorities are the answer. In this article, Neil Dryden and Ben Dubowitz [1] assess the impact of this divergence and whether competition authorities can achieve better outcomes for their own consumers. Using a stylised model, they show that in cases where each competition authority wields an effective veto, there are higher rates of merger prohibition and higher overall policy error rates. They then consider possible strategies that authorities could adopt in principle to minimise policy error and improve consumer outcomes.

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Introduction

When a global merger is assessed by multiple competition authorities, and the affected markets are global, the various competition authorities should (at least if they operate to the same statutory test) reach the same conclusion: the merger is either anti-competitive or it isn’t. However, if individual authorities err in their assessment, this raises the possibility that different authorities could reach different conclusions.

This possibility of error is more serious when the only remedy (which we take to be not merging) is global, because in that case each competition authority wields an effective veto over the merger and there is a chance that the veto is exercised by mistake, that is, over a pro-competitive merger.

The purpose of this article is to examine the tendency for erroneous vetoes (and erroneous clearances) to occur and to explore (at least theoretically) how competition authorities could adapt in light of them. As we describe, it may be optimal for individual competition authorities to abstain from merger control with some probability, or to apply a higher threshold of confidence before reaching an adverse finding, when other competition authorities are also reviewing the merger.

Critically, the motivation for these possible responses is different from the more often discussed ideas to address divergent outcomes in global merger control, namely cooperation and comity. In particular, the ideas in this article arise where cooperation still leaves space for divergent outcomes, and it differs from comity, as the response we examine to the multi-jurisdictional environment is not done out of any deference by one authority to other jurisdictions, but rather with the aim of producing the right outcome for that authority’s own consumers.

We proceed as follows: first, we expand briefly on the notions of cooperation and comity, to make the different focus of our analysis clearer; second, we set out a basic stylised model of merger control, examine outcomes when individual competition authorities do not take into account each other’s presence, and then when they do; and, finally, we set out some brief concluding comments.

Cooperation and comity

It is generally held that cooperation among competition authorities is a desirable objective, and it is one that most, if not all, competition authorities pursue to some degree.

For example, Sarah Cardell, Chief Executive of the UK’s Competition and Markets Authority (“CMA”), has recently commented that “it is generally beneficial to merging parties and competition authorities for there to be open channels of communications between different authorities internationally”.[2]

Consistent with this, the UK and the EU have recently started negotiations on a Competition Cooperation Agreement. In a letter released at the end of April 2024 announcing the launch of negotiations, it was stated that the agreement aims to “benefit the UK by creating a formal framework to cooperate and strengthen cross-border enforcement of competition law”.[3]

From an economics point of view, we can hope that cooperation, whether generally or on individual cases, should reduce the rate of errors (whether incorrect blocks or clearances) by agencies. At the same time, cooperation is not without risk, in particular from a loss of otherwise beneficial independent thinking, but that is not our focus here.

A second, and more vexing concept is comity, defined by Concurrences as meaning “to urge or demand that the institutions of one jurisdiction take the interests of one or more other jurisdictions into consideration in making legal decisions”.[4]

The notion of comity has been cited various times by the UK’s Competition Appeal Tribunal (“CAT”), including in Meta/Giphy, where the CAT stated that “the demands of comity do require the CMA to be at least conscious of the international dimension”, adding that “in international cases, regard needs to be had (even if it is not determinative or even immaterial) to the wider context”.[5]

However, the requirement to be “conscious” is not a high one, and the CAT offered no indication of what this would mean in practice (noting that no detailed submissions were made to it on this subject).

Moreover, it is not clear there is a good answer to what comity might mean in practice. A recent academic review of comity noted it remains “one of the most ambiguous and multifaceted conceptions in the law” and “so elusive and imprecise […] to render its use unhelpful and confusing”.[6]

Sarah Cardell has also appeared to address comity, as follows: “When we carry out a merger assessment on a global deal, we are highly attuned to the fact that we do not operate in an international vacuum. But ultimately, our responsibility is to take our decisions applying our rules for the protection of UK consumers.”[7] This appears to be a nod to the CAT’s requirement for the CMA to be conscious of the international dimension, but at the same time to rule out comity, if interpreted as any deference to another agency at a cost to UK consumers.[8]

In what follows, we explore a concept that is different from cooperation and comity. In particular, we address a situation in which authorities may diverge on the same assessment (which could be viewed as a consequence of imperfect cooperation) and we find a role for agencies adapting their approach taking account of the presence of other agencies. They do not adapt their approach because of any deference – implying a sacrifice of the interests of their own consumers – but they do so purely to increase the chances of obtaining the correct outcome for their own consumers; namely that an anti-competitive merger should be cleared and a pro-competitive merger should be blocked.

A simple model of merger review with one competition authority

In order to conduct our analysis, we adopt a very simple, and wholly illustrative, model of merger review by a competition authority (“CA”), embodying the notion that CAs can make decisional errors.

This model has the following features:

- All mergers are either pro- or anti-competitive, with equal probability. While not intended to reflect reality, this may be a broadly reasonable description of the more “edge” case mergers where CAs are prone to error.

- A CA decides whether to block or clear on the balance of probabilities. The CA blocks the proposed merger if its assessment shows the merger is more likely anti-competitive and clears the merger if its assessment shows the merger is more likely pro-competitive.

- A CA’s decision is subject to error. We assume that the CA has an error rate of 25%, equally split between incorrect blocks and incorrect clearances.

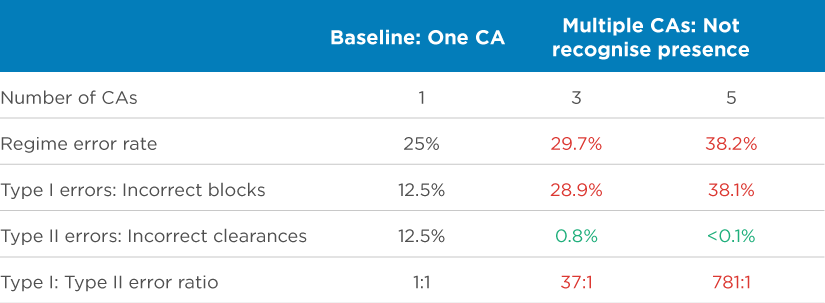

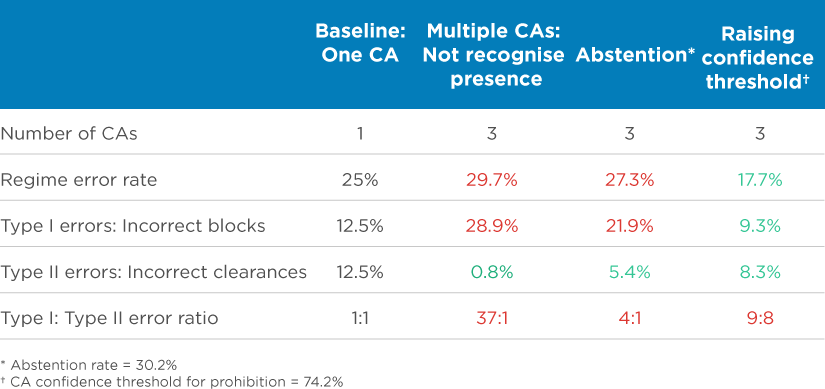

The error rate used, and therefore the numbers that follow, are intended to be illustrative. Merger control is not an easy task as it requires comparing an unknown prospective factual against an unknown prospective counterfactual. In reality, CAs not only have imperfect foresight of how markets will evolve, but also imperfect knowledge of the present state of the market. This makes error a fact of life for such procedures – the exact rate used to illustrate this is less important (for our purposes). The table below summarises the error rates in the baseline model considering only one CA.

Table 1: Regime error rate in the baseline model

Review by multiple authorities when they do not account for each other’s presence

We now consider the situation where multiple CAs assess the same global merger, which we take to involve global markets and only have a global remedy. This implies that the CAs should reach the same conclusion (subject to having the same statutory test) and that a block by any one CA, including an erroneous block, operates as a veto.

As far as the CAs are concerned, we assume that each is a “clone” of the single CA above, and that each CA assesses the merger and reaches a conclusion that is positively correlated with the true state of the merger (meaning each CA is correct 75% of the time, as above), but is not additionally correlated with the assessment of other CAs. This can be considered as a case of no cooperation in assessment (the results that follow would be less extreme assuming some degree of cooperation).

We start by assuming that each CA makes its decision ignoring the presence of the other CAs. In that case, the table below shows the regime error rate (in the cases of three and five CAs) compared to our baseline model of one CA – we refer to “regime” since the CAs effectively amount to a regime, with their individual decisions combining to determine the fate of the merger.

Table 2: Regime error rate comparison

As we can see, moving from one to three CAs moderately increases the regime error rate, from 25% to 29.7%. However, the mix of incorrect blocks and clearances changes dramatically, from equality (1:1) to 37:1 in favour of incorrect blocks.

The reason for the moderate increase in the overall regime error rate is that moving from one to three CAs all but eliminates the chance of a false clearance – as this requires all three CAs to wrongly conclude an anti-competitive deal is pro-competitive – and this collapse in false clearances is only somewhat outweighed by the increase in false blocks (which require only one CA to wrongly block a pro-competitive merger).

But, as we can see, once the false clearances are largely eliminated (which is already the case with three agencies), further increasing the number of CAs adds more false blocks (again, since only one wrong decision is needed for a false block) and this adds significantly to the overall regime error rate.

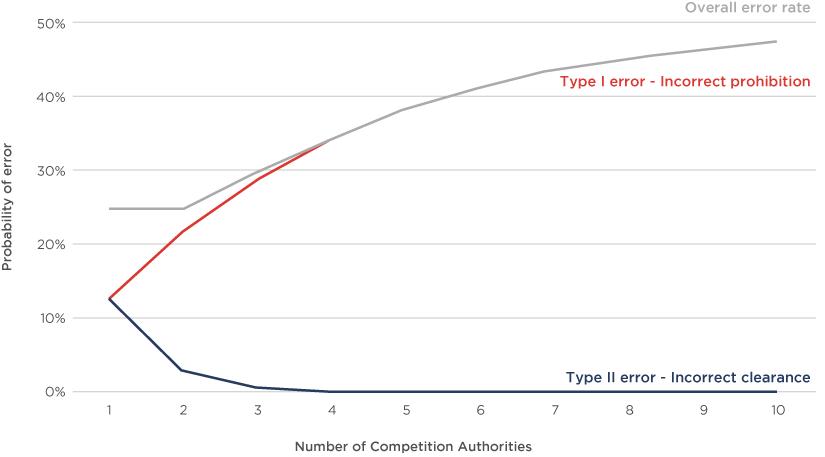

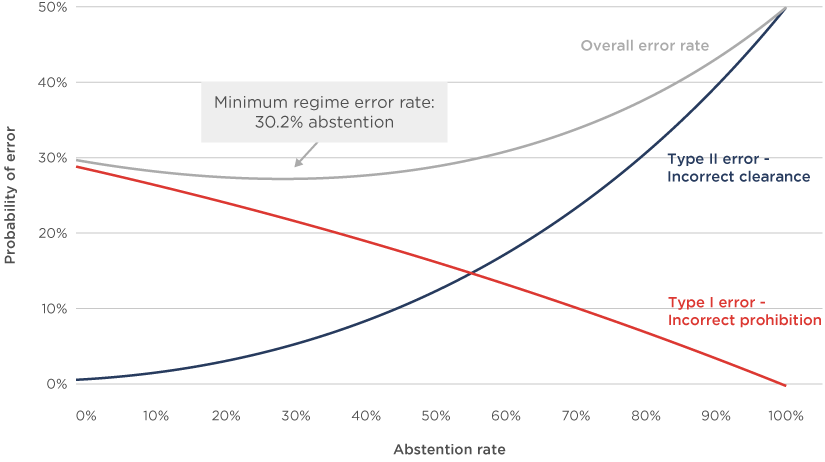

The figure below shows how the overall regime error rate increases as the number of CAs increases from two to ten, and how the overall error is split between incorrect prohibitions and incorrect clearances.

Figure 1: Regime error rate, type I and type II error rate with no accounting for presence of other CAs

As shown above, by the time ten CAs are willing to exercise a veto (admittedly a large number), the regime error rate is close to half. In practice, this means that nearly all mergers are being blocked: one half correctly so (because they are anti-competitive), but the other half incorrectly (because they are pro-competitive, but at least one CA made a mistake).

Abstention

We now analyse two hypothetical ways in which CAs can account for each other’s presence, with the aim of producing better regime outcomes: abstention and (in the next section) raising thresholds of confidence. We do not analyse two other possibilities: cooperation (since it is a more obvious point, as discussed above) and majoritarian rule (since that would require fundamental legal and political change).[9]

Procedurally, a CA might abstain in different ways. It could abstain from reviewing a global merger if it knows that other CAs will assess the merger in any case. Alternatively, it might choose to abstain from prohibiting a global merger that it has deemed to be anti-competitive – although it may still impose behavioural or non-fatal remedies – for instance, recognising that such a full prohibition may have a disproportionate impact on consumers and business activities that fall under the purview of other CAs.[10]

Regardless, the impact of abstention is the same: it reduces the regime error rate simply by virtue of reducing the number of CAs that wield veto power. If enough CAs abstain, and we are left with only one CA, then overall error rates will return to those described in our baseline model. Otherwise, abstention mitigates the problem we observe in a world where CAs do not account for each other’s presence. However, in no circumstances can this approach strictly improve on the outcomes that a regime with a sole CA would achieve.

To illustrate the impact abstention has on regime error, we assume that each CA with the opportunity to investigate the global merger has a percentage chance of abstaining, which is identical for all CAs.[11] Over a large number of global mergers, the abstention rate can be thought of as the proportion of assessments in which a CA chooses to abstain.

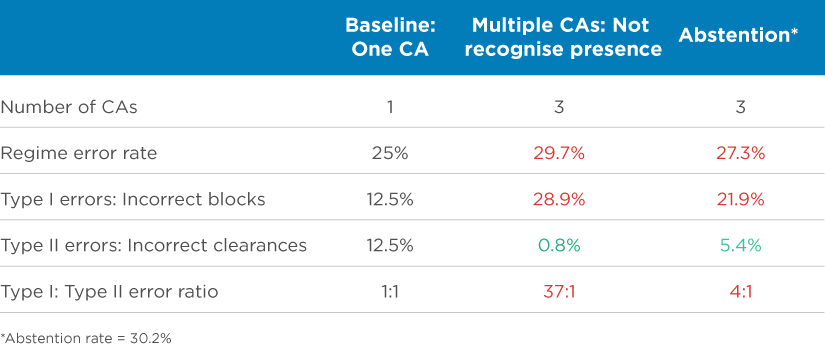

The table below sets out how the error rates under abstention (in the case of three CAs) compares to our previous scenarios.

Table 3: Regime error rate comparisons

The regime error rate is better compared to our previous scenario of no recognition. The overall regime error rate with three CAs falls from 30% to 27%, and the overweighting of type I vis-à-vis type II errors falls from 37:1 to 4:1.

However, the regime error rate under abstention is still worse than in the baseline case with one CA. This is in fact true for all numbers of CAs greater than two.[12] The reason for this is because the negative impact of a CA veto outweighs any benefits from more CAs gathering evidence, as CAs are still bound by the balance of probabilities framework once they elect not to abstain.

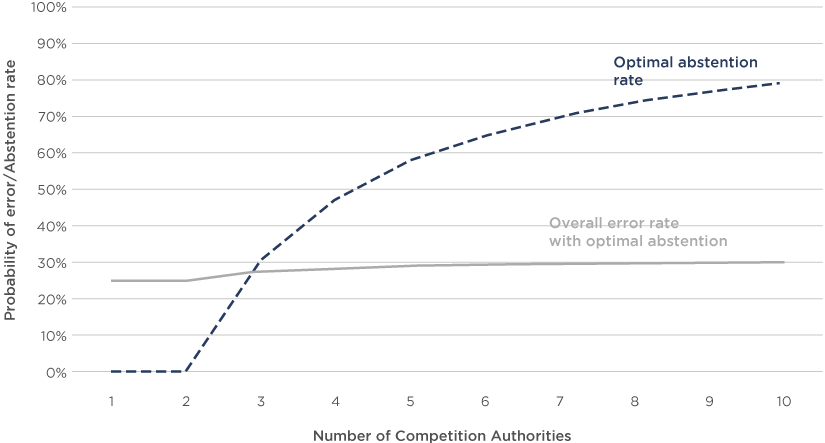

The figure below sets out in more detail how the overall regime error rate changes as the probability of each CA abstaining increases in a scenario with three CAs and identifies the abstention rate (30.2%) that minimises the regime error rate.

Figure 2: The impact of varying abstention rates on overall regime error: regime with three CAs

In reality, an important barrier for the abstention approach is a practical one: how to ensure that an optimum percentage of CAs abstain. The results above assume that CAs act optimally; however, it is not easy to devise a system which brings this into effect. All things being equal, it is likely that a CA with the opportunity to assess a merger would prefer to review it, rather than not.

Importantly, abstention is a sticking plaster. Even at the optimum level of abstention, the regime can never improve on the outcomes that a single CA acting alone could achieve. The figure below shows the overall regime error rate as the number of CAs increases assuming the optimum abstention rate is adopted in each case. The total error rate (the solid grey line in Figure 3) is marginally higher than the one with just one CA reviewing in all cases, and those errors skew toward incorrect prohibitions, with around four incorrect prohibitions for every incorrect clearance. Furthermore, the optimum abstention rate needed to achieve those outcomes gets larger (the dashed line in Figure 3), and increasingly challenging to achieve in practice, as the number of CAs increases. So, the abstention approach becomes increasingly difficult to achieve in practice, and always falls short of the outcome that a single CA acting alone could achieve.

Figure 3: Regime error rate, total error rate under optimal abstention as the number of CAs increases, and the abstention rate needed to achieve optimum outcomes

Raised threshold of confidence

An alternative way to address the problem of regime error rates is that CAs could have a higher threshold of confidence when they consider prohibiting a merger that other jurisdictions have already assessed or will assess. In other words, for global mergers, one could increase the standard of proof from “balance of probabilities” towards something more stringent, such as “beyond reasonable doubt”.

The principle is that the effective threshold of confidence that the regime as a whole applies is what should matter, not each CA in isolation. When CAs wield effective vetoes, it is the regime that determines outcomes. By each CA increasing its own threshold, it takes into account the impact its effective veto has on other assessments and regime error. In essence, this approach seeks to ensure that the regime’s effective confidence threshold is roughly equivalent to the “balance of probabilities”, not each CA in isolation as it is the regime that determines outcomes.

Notwithstanding that, like the abstention approach, this may be difficult to implement, we proceed to illustrate the impact that adjusting each CA’s thresholds has on the regime’s error rate. To model this, we assume that each CA’s assessment of the merger outcome has a degree of confidence associated with it (e.g., they are 70% sure the merger will be anti-competitive). This signal is distributed from 0-100% and is correlated with the true merger outcome (anti-competitive mergers produce more anti-competitive signals) but not with other CAs’ information.[13] The CA can therefore choose the confidence level at which it will block the merger, previously anchored by the balance of probabilities test at 50%.

The table below sets out how the error rates under a model of raised thresholds compares to those produced in our other models.

Table 4: Regime error rate comparisons

Adopting raised thresholds of confidence can lead to a strictly better overall regime error rate than any of the other approaches discussed, and better than the single CA can achieve. At the optimum confidence threshold, the regime error rate is almost a third lower (17.7% compared to 25%) than under a single CA system. This is because the regime is able to use the increased amount of evidence gathering to improve decision making.[14] It also leads to markedly improved rates of incorrect blocks and incorrect clearances compared to the abstention approach.

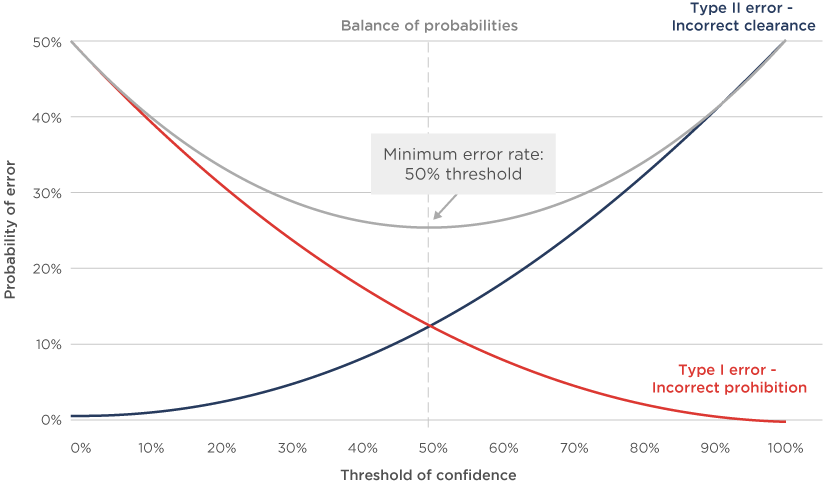

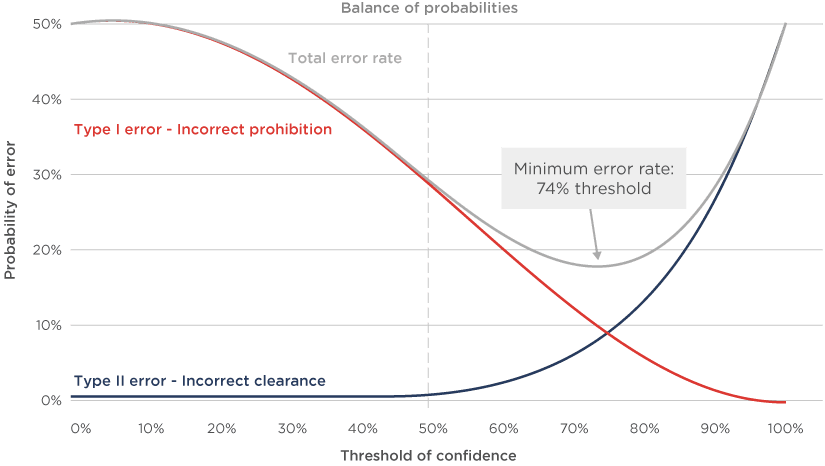

The two figures below show the error rates as the confidence threshold increases in a scenario with one CA and with three CAs.

Figure 4: The impact of varying confidence threshold on overall regime error: regime with one CA

Figure 5: The impact of varying confidence threshold on overall regime error: regime with three CAs

By increasing the confidence threshold set for each CA, in isolation, it is more likely each decides to clear an anti-competitive merger, and less likely each decides to block a pro-competitive merger. So, in the scenario with only one CA, the optimal confidence threshold is 50% and this produces a 25% CA error rate – the same as in our baseline described above.

However, in the scenario with three CAs, the optimal confidence threshold is about 74%. This is because it is better for each CA to be more cautious when exercising its veto, even to the point of accepting higher individual error rates, as this leads to lower overall regime error rates. The intuition for this result is that, if a CA receives a moderately strong signal of anti-competitive effects (e.g., 50-60%), then it expects that if the merger truly is anti-competitive someone else will receive an even stronger signal.

Moreover, adopting optimal confidence thresholds, the regime error rate decreases as the number of CAs increases as each CA can rely on those CAs that receive very strong signals, albeit optimistic to assume a large number of CAs would adopt the framework.

Concluding remarks

Multi-jurisdictional review of global mergers is often met with suggestions that there is a need for cooperation and (more controversially and less clearly) comity. This article suggests that CAs reviewing a global merger could in principle achieve better regime outcomes by abstaining or (perhaps more realistically) being more certain before blocking. Crucially, in our framework, this is not out of deference to other jurisdictions, but with an aim to producing the right outcome for that agency’s own consumers.

At one level, the confidence threshold point should be uncontroversial: before blocking a merger when there are more CAs involved, it becomes more important to be at least somewhat more sure, as the only circumstances in which a block of one CA matters in practice is when all other CAs clear, and in that case the chance that the block decision was a mistake is quite high.

Anticipating perhaps one line of criticism: this article does not advocate soft(er) merger control. The issue of toughness can be addressed even by one agency in its confidence threshold and in weightings given to type I and II errors (which we took to be equal when evaluating regimes). The multi-jurisdictional issue is conceptually separable from the issue of toughness and may merit more consideration, especially if the number of agencies prepared to intervene on global deals increases.

View the PDF version of this article.

Read all articles from this edition of The Analysis.

References

-

Neil Dryden is Co-Head of Compass Lexecon’s EMEA practice. Ben Dubowitz is an Economist at Compass Lexecon. We would like to thank Adrian Er, Intern, for research assistance, and Mark Robinson, Research Analyst, for modelling support. The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

-

Cardell (2023), “Sarah Cardell: the future of UK merger control”.

-

Hollinrake & Ghani (2024), “Launch of UK-EU Competition Cooperation Agreement negotiations”.

-

Gerber, “Comity”, Global Dictionary of Competition Law, Concurrences, Art. N° 12200.

-

Case 1429/4/12/21, Competition Appeal Tribunal (2022), Meta Platforms Inc. v CMA (2022), ¶127(1) and ¶129.

-

Mann, “Foreign Affairs in English Courts” (Oxford: Oxford University Press 1986) p. 134-136. quoted in Schultz, T., & Mitchenson, J. (2018). “Rediscovering the Principle of Comity in English Private International Law”. European Review of Private Law, 26(3), p. 312.

-

Cardell (2023), “Sarah Cardell: the future of UK merger control”.

-

However, see footnote 10 below for further positive reference to comity by the CMA.

-

A majoritarian rule would lead to strictly better outcomes than any veto-based regime: in the case of three CAs it requires that two CAs err in order for the overall outcome to be incorrect rather than only one (in the case of incorrect prohibitions) or all (as in the case of incorrect clearances) as in a veto regime. In concrete terms, this means that with three CAs the total regime error rate would be 15.6%.

-

In Hitachi/Thales, the CMA noted that: “As part of our proportionality assessment, we have also had regard to the international context of the Merger. […] Both the Primary Divestiture Remedy and prohibition have effects outside GB but as these are the only effective remedies to address the SLC and its adverse effects in GB, the fact that each will necessarily have an impact outside GB does not conflict with the principles of international comity […] In this case, we have not identified any effective remedy that would avoid extra-territorial effects. […] we are satisfied in this case that either of the effective remedies is a proportionate remedy that respects the principles of international comity, notwithstanding the extra-territorial effects”. Final report, paras 13.750-13.754, available here.

-

We note two shortcomings with this approach: (i) CA abstention rates are likely to be correlated with other factors: for example, if the rule is based on regional revenue share, then if the revenue share in the US is low, all else being equal it should be higher in the EU, and abstention rate would be higher in US than in EU; and (ii) under this abstention regime, it is possible for no CA to review a merger (in effect the merger is waved through without review).

-

As the number of CAs increases, the regime error rate with no recognition of presence approaches 50%, and under abstention it approaches ~31%. With two CAs, the regime error rate is the same as with one CA under both regimes (25%), but with seven incorrect prohibitions to every one incorrect clearance.

-

If a CA is forced to adopt the balance of probabilities (i.e., that their confidence is greater than 50%), then this modelling assumption has no impact on the previous results discussed above.

-

There is a wide range of outcomes where the overall error rate beats a single CA regime; namely, any threshold between 57% and 87%.