Survey Evidence on Multi-homing in Online Retail Businesses

Share

John Davies, Sergey Khodjamirian, Felix Giallombardo and Pietro Aletti [1] explore empirical evidence on multi-homing in online retailing in the context of “gatekeepers”. They find that designating companies as a gatekeeper purely on the basis of its size seems rather arbitrary and unjustified by economic principles; rather, the criteria for gatekeeping should reflect the economic concepts that affect competition, particularly multi-homing.

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Introduction

In this article, we (i) briefly explain the importance of multi-homing for assessing the market power of platform intermediaries, (ii) explore the role that multi-homing plays in the definition of “gatekeepers” in emerging European legislation, and (iii) summarise empirical evidence on multi-homing in online marketplaces. This summarises our paper, which presents detailed results that had not previously been in the public domain from surveys of buyers and sellers on online platforms.[2]

The importance of multi-homing for assessing whether a potential gatekeeper has market power

The gatekeeper concept is at the heart of the European Digital Markets Act (“DMA”) and similar legislation proposed by various European countries.

Although there is no universally agreed definition of what constitutes a gatekeeper, common to any notion is that it provides exclusive access to its users. Most undertakings being targeted by these pieces of legislation are “platforms” intermediating interactions between different types of users (commonly businesses and end-users – such as app users and app developers, advertisers and consumers, and online retailers and customers). A key question is whether users of these platforms rely on the intermediary to reach each other. If the gatekeeper provides access to its users exclusively, then it can dictate terms. If multiple other avenues are available, then controlling just one “gate” among many offers limited power.

As such, whether or not a platform is a meaningful gatekeeper does not depend only on the number of people that use its intermediary services. It depends on the proportion of users that use only the alleged gatekeeper’s service for the activity under investigation (known as single-homing) and the proportion that also use alternatives (known as multi-homing). If businesses and end-users use more than one intermediary (multi-homing), then neither would be forced to go through the intermediary under investigation to reach the other side to conduct transactions, and that intermediary is thus unlikely to be a gatekeeper. Multi-homing therefore represents a significant constraint on an intermediary’s power.

Few European jurisdictions account for multi-homing when defining gatekeepers

Despite the importance of multi-homing, the DMA and most of the other new legislation put little or no emphasis on multi-homing when designating large undertakings as gatekeepers. In doing so, these legal instruments may identify as gatekeepers some digital intermediaries which are large but in fact have no meaningful gatekeeping ability because their users multi-home.

The European Commission (“EC”) has referred to gatekeepers as “bottlenecks” that business users cannot get around. In the DMA legislation itself, however, the gatekeeper designation is based primarily on simple rules: an undertaking is presumed to have gatekeeper status if it provides certain “core platform services” and satisfies a set of specific quantitative thresholds (e.g., number of users).[3,4] The largest digital intermediation services will most likely meet these quantitative thresholds and therefore be designated quasi-automatically as bottlenecks, irrespective of whether their users multi-home or not.

Italy is proposing to introduce into its existing law on abuse of economic dependence a rebuttable presumption of dependence for “A company that offers intermediation services on a digital platform, when the latter has a decisive role in reaching end users (particularly when there are network effects or the company collects data from users)”.[5] Although the Italian law does not address multi-homing directly, it does consider the availability of satisfactory alternatives of the “weakest” party in the contractual relationship as a relevant factor in determining the existence of an economic dependence situation.[6]

The UK’s Competition and Markets Authority (“CMA”) is proposing a regulatory regime for firms deemed to have “strategic market status” (“SMS”), which would be assigned through a structural analysis of market and firm characteristics, and should apply to companies which have a “position of enduring market power or control over a strategic gateway market with the consequence that the platform enjoys a powerful negotiating position resulting in a position of business dependency”.[7] Although the UK government is still developing the SMS test and accompanying regulation, the CMA’s online platforms and digital advertising market study considered multi-homing as a factor increasing competitive pressure, and it is therefore clear that it considers consumer multi-homing to be an effective check on an incumbent becoming entrenched.

Since 2021, Germany has allowed its Federal Cartel Office to place behavioural restraints similar to the DMA’s, on “undertakings of paramount cross-market significance”.[8] In the case of multi-sided markets and networks, dominance is evaluated taking into account a number of qualitative factors including “the parallel use of services from different providers and the switching costs for users”.[9]

Whatever the legal test, what should matter for competition is whether users can and do multi-home

Although legal tests vary, an economic assessment of whether a digital intermediation service is a gatekeeper or not is ultimately an empirical question: do its users multi-home, and can they easily shift to an alternative provider?

The nature and prevalence of multi-homing will vary depending on the market. To illustrate the point, we explore the different ways that consumers and sellers on online e-commerce platforms can multi-home and the extent to which they do so. Importantly, the economics of multi-homing depends on whether users have alternative avenues to reach each other, not whether those avenues take the same form as the potential gatekeeper. In e-commerce, an alternative home might be a rival e-commerce platform, a seller’s own website, or a physical department store.

As a result, the survey data discussed below suggests that multi-homing by both consumers and sellers on online marketplaces is common, and that those businesses are less likely to be gatekeepers in an economic sense than other digital intermediation services (such as app stores or search engines) considered by the DMA and similar initiatives.

Many consumers multi-home when buying online

Consumer multi-homing, in general, is defined as when consumers consider two or more shopping destinations, potentially both offline and online, when making purchases: colloquially known as “shopping around”. Consumer multi-homing in e-commerce can be measured in several different ways.

First, browsing behaviour related to a particular shopping mission can show multi-homing. For example, if a consumer says that when they purchased a USB key from Fnac, they also checked the same or similar products on CDiscount and eBay.

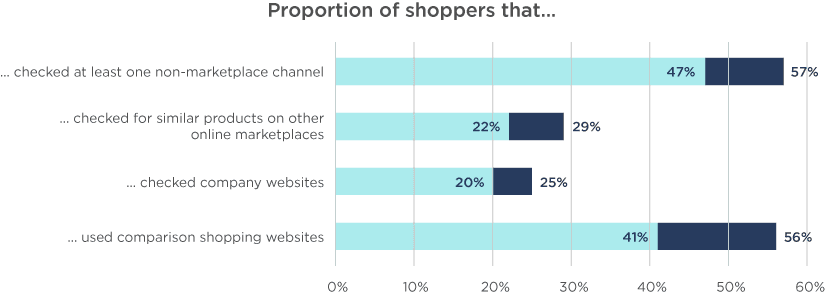

Several surveys in the public domain have assessed this type of multi-homing. In 2020, Amazon commissioned a survey of buyers on online marketplaces across five European countries.[10] Shoppers reported actively checking other online destinations when making a specific purchase:

- 47% - 57% (depending on the country) checked at least one non-marketplace channel;

- 22% - 29% checked for similar products on other online marketplaces; and

- 20% - 25% checked company websites.

Furthermore, 41% - 56% reported having used comparison shopping websites. In addition, the survey found that shoppers actively research prices on other channels; for example, 54% of respondents in Italy and 48% of respondents in Spain stated that they always or frequently checked prices in physical stores.

Consistent with this, Criteo (2016)[11] found that between 22% - 43% of online shoppers used at least two retail e-commerce sites when browsing for a given product, depending on the product category.[12] In a follow-up (Criteo, 2017)[13], 29% - 47% of respondents (depending on the country) stated that they often visit multiple websites to compare products in the apparel category. Furthermore, a ComScore survey of around 3,000 US online shoppers found that 68% of consumers visited Amazon.com in the seven days leading to a non-Amazon purchase, [14] with 28% visiting Amazon in the same session as their retail purchase. Finally, a 2021 Deloitte survey of 8,000 retail consumers in the United States found that 60% of in-store purchasers reported doing online research and 56% of online purchasers reported doing research in-store.[15]

Second, actual purchasing behaviour over time within the same product category also provides evidence of multi-homing. For example, if a consumer purchased cycling gloves from Retailer A in January and then a cycling helmet from Retailer B in June, the consumer is likely to have considered both retailers each time, shopping around.

In the Amazon buyer survey, respondents who made more than one purchase in the same product category were asked what channels they used for making purchases in the past twelve months in that product category.[16] The survey found that 45% - 61% of marketplace shoppers (across the five countries analysed) used at least two channels (for example, physical stores in addition to online marketplaces) when purchasing products from the same product category within the past year. The survey also asked about multi-homing within the marketplace channel and found between 57% and 70% of respondents used at least two marketplaces for purchases in the same product category in the past twelve months. Thus, it was clear that the majority of marketplace users both multihomed across channels, and within online marketplaces, using different types of retailers for similar products.

Finally, using multiple retailers for different products can provide additional evidence on the potential for multi-homing. If a consumer uses Fnac for electronics and Carrefour for food, Carrefour will provide an easy alternative for electronics purchases and the consumer may know this and even see electronics prices on visits to shop for food.

Surveys have found that large majorities of consumers use more than one online marketplace. The Comscore survey found that 59% of those who made between two and five purchases in Q4 2017 used two or more marketplaces, compared to 85% of those who made ten or more purchases. In the Amazon buyer survey, consumers were asked to think about all their online purchases in the past 12 months, and report all the marketplaces they have used. Between 71% and 81% of consumers across the five countries used more than one marketplace for online shopping. In July 2020 the economist Pinar Akman, in collaboration with survey company YouGov, conducted a survey of 11,151 consumers across ten countries, finding that marketplace consumers across the world use between 2.65 (China) and 3.96 (Brazil) online marketplaces for their online shopping and between 52% (Germany) and 77% (Singapore) of those consumers use more than one online marketplace.[17]

Consumers react to price increases

Of direct relevance to any economic assessment of consumer behaviour – but harder to measure – is the consumer response to price changes or other changes that might cause them to seek alternative retailers. This is of obvious relevance to gatekeeping: if the gatekeeper were to try to exploit those consumers using its service, would they switch away to an alternative?

The Amazon buyer survey asked about how consumers would behave if prices increased across all online marketplaces. The survey found that around 30% of consumers on online marketplaces would switch away to other non-marketplace channels in the face of a 5% increase in prices on online marketplaces, indicating high price sensitivity of consumers.

This willingness to move away in response to a small price increase is perhaps unsurprising, given the evidence cited above on how much consumers shop around, but it is very relevant to an economic assessment of whether any online marketplace can be considered a gatekeeper. Competition authorities usually consider such a test of how many consumers would switch to alternatives in the face of a small price increase, when assessing whether companies have market power. If enough consumers on online marketplaces readily switch to alternatives when prices increase, this is a competitive constraint on online marketplaces: coming from goods suppliers’ own websites, from physical stores and other sources (in addition to the competition between different online marketplaces themselves).

Sellers also multi-home

If a marketplace’s consumers multi-home, then that alone should imply it is not a gatekeeper, as it is unlikely to be able to prevent sellers from reaching the consumers active on the marketplace, as sellers could simply switch to another service. Conversely, multi-homing by sellers when consumers single-home does not necessarily indicate that sellers have alternatives. In this situation, each marketplace would provide access to a different group of consumers, so sellers would have to multi-home across marketplaces to reach them all. A large marketplace, controlling access to a large number of consumers, could then be an unavoidable partner and indeed a gatekeeper in a rather natural, metaphorical sense.

However, when consumers multi-home, as the evidence reviewed in the previous section suggests they do, seller multi-homing provides additional evidence that sellers can and do take advantage of the alternative routes to reaching consumers.

Surveys have shown that sellers use a wide range of methods to reach consumers. In parallel with the buyer survey described above, Amazon also commissioned a survey of sellers on online marketplaces in 2020. The survey covered 1,000 sellers, targeting an equal number of small, medium and large businesses actively selling on online marketplaces in the UK and Europe.[18] Between 79% and 87% (depending on the country) used at least one non-marketplace channel to reach consumers. Between 47% and 62% used their own company website, between 27% and 38% used brick-and-mortar stores and 44% to 68% used social media to reach consumers. The survey showed that the majority (between 54% and 80%) even of small seller respondents used at least one other channel.

To complement the above results, the survey also looked at the proportions of revenue sellers obtained over different channels. As this was a survey limited to sellers on online marketplaces, it is not surprising to find that sellers made on average between 57% and 67% of their annual revenues on online marketplaces. Nonetheless, sellers depended on multiple marketplaces for their revenue and no single marketplace accounted for more than 15% to 29% of sellers’ revenues across the five countries. Moreover, online marketplace sellers also derived between 33% to 43% of their revenue across the five countries from non-marketplace channels, such as brick and mortar stores, webstores, and social media.

Within the marketplace channel, 73% to 82% of sellers reported using more than one marketplace. Again, this proportion was lower for smaller sellers (between 54% and 73%), but still showing significant seller multi-homing.

These results are consistent with other surveys of sellers. A PAC survey of 200 European retail companies in 2015 found that 54% of respondents sell through 3 or more channels (such as via an online store, an app, physical store, pop-up store etc.).[19] Deloitte’s 2021 Retail Today carried out a survey of 1,000 small and medium sized retailers and found that 47% sell both online and offline, whilst only 34% used online channels only (marketplaces and own websites).[20]

Conclusion

The findings of surveys indicate a high degree of multi-homing both on the consumer and seller side. Amazon’s 2020 surveys of consumers and sellers provide the most detailed assessment of how this multi-homing manifests itself and the implications for assessing whether marketplaces can be considered gatekeepers.

The European Union appears to intend to adopt a form-based approach in which all large companies providing digital intermediation services connecting businesses and customers are likely to be designated gatekeepers. However, if the DMA is intended to ensure contestability and protect competition, then its criteria for gatekeeping should reflect the economic concepts that affect competition, particularly multi-homing. The evidence shows that users on both sides of e-commerce sites (or at least online marketplaces) multi-home, so they are not captive to the owners of those sites.

Designating any such online marketplace as a gatekeeper purely on the basis of its size therefore seems to be rather arbitrary and unjustified by any economic principles. Similarly, the evidence does not seem to justify presuming that sellers are economically dependent on the services of online marketplaces.

View the PDF version of this article.

Read all articles from this edition of the Analysis

[1] The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

[2] The full paper is available at https://storage.googleapis.com/compass-lexecon-assets/legacy/2022/07/Survey-Evidence-on-User-Multi-Homing-in-Online-Retail-Businesses.pdf.

[3] Digital Markets Act, Art 2 – (1), (2), 3.2 (May 2022).

[4] If an undertaking does not satisfy one or more of the quantitative criteria, then the EC will consider a different set of criteria, one of which includes multi-homing (Article 3(8)(e)).

[5] Proposed changes to L.192/1998 (p. 25) https://www.ansa.it/documents/1636051142145_concorrenza.pdf (IT). Original Italian: “Salvo prova contraria, si presume la dipendenza economica nel caso in cui un’impresa utilizzi i servizi di intermediazione forniti da una piattaforma digitale che ha un ruolo determinante per raggiungere utenti finali o fornitori, anche in termini di effetti di rete o di disponibilità dei dati.”

[6] Art. 9(1) L. 192/1998 https://www.agcm.it/competenze/tutela-della-concorrenza/dettaglio?id=58e16284-f1d9-4712-9db9-cfcf13959ec4&parent=Normativa&parentUrl=/competenze/tutela-della-concorrenza/normativa.

[7] CMA, Online platforms and digital advertising market study, final report, 2020, paragraph 7.55

[8] Germany’s proposed competition law reform (p. 19-22). https://dserver.bundestag.de/btd/19/258/1925868.pdf (GER)

[9] D’Kart, Gesetz gegen Wettbewerbsbeschränkungen 2021 Wichtige Änderungen durch das GWB-Digitalisierungsgesetz (10. GWB-Novelle) – Konsolidierte Fassung (14.1.2021), section 18, paragraph 3a (translated from German) GWB-2021-konsolidierte-Vorschriften.pdf (d-kart.de).

[10] Conducted by market research firm Alligator Digital with assistance from Compass Lexecon.

[11] Criteo, Browsing & Buying Behaviour, 2016: United Kingdom Q3 2016. Criteo operates an ecommerce media exchange and has data on over 90 billion yearly ecommerce searches and £96 billion in ecommerce transactions. The company also has access to cross-site consumer shopping data. https://www.criteo.com/wp-content/uploads/2018/01/Browsing-Buying-Behaviour-2016-UK.pdf.

[12] The categories covered were Electronics, Home, Furniture, Toys & Games, Baby Care, Apparel & Accessories, Health & Beauty.

[13] Criteo, The Shopper Story 2017: a global study of the changing nature of retail from the viewpoint of nearly 10,000 shoppers. (https://www.criteo.com/wp-content/uploads/2017/10/TheShopperStory_US_Final.pdf).

[14] ComScore, State of the U.S. Online Retail Economy Q1 2018, 2018 p. 26.

[15] Deloitte, Consumer Preferences Embrace a Mix of Physical and Digital, 2021. https://www.deloittedigital.com/content/dam/deloittedigital/us/documents/offerings/offerings-20220125-insightiq-ccia-consumer-preferences-embrace-a-mix-of-physical-and-digital.pdf.

[16] Respondents could choose from marketplaces, “online store”, “from a physical shop” or some other channel.

[17] Akman, Pinar, A Web of Paradoxes: Empirical Evidence on Online Platform Users and Implications for Competition and Regulation in Digital Markets (March 29, 2021). 16 (2) Virginia Law and Business Review 217 (2022), Available at SSRN: https://ssrn.com/abstract=3835280 or http://dx.doi.org/10.2139/ssrn.3835280.

[18] These size categories are based on total revenues in 2019: Small = less than EUR 100k in revenues; Medium = between EUR 100k and 5M in revenues; Large = more than EUR 5M in revenues.

[19] PAC is a consulting, research, marketing services company. https://ecommercenews.eu/omnichannel-retail-europe/.

[20] Deloitte, Retail Today, 2021. https://www.deloittedigital.com/content/dam/deloittedigital/us/documents/offerings/offerings-20220125-insightiq-ccia-retail-today.pdf.