The simple economics of energy prices

Share

The European Commission warned in September 2022 that “the next winters – not just this one – will be difficult, make no mistake about that”.[1] In this article, Joe Perkins [2] and Clemence Rainaut review the various interventions governments made to support households and businesses. Future energy support schemes should better meet the twin objectives of providing support for essential use, particularly by vulnerable groups, and maintaining effective signals for reducing demand over time.

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Introduction

In the short term, prices play two central roles in the operation of a market:[3]

- First, they affect the distribution of surplus between the sellers of a good and its consumers. Other things equal, when prices rise, suppliers receive more of the surplus, and consumers less.

- Second, they help to balance supply and demand within a market. Higher prices tend to increase supply and reduce demand, while lower prices have the opposite impact.

If the first role of prices has been central to recent discussions of energy market dynamics in Europe, the second role of prices, in balancing supply and demand in a market, has been largely overlooked. We discuss in this article how this could make interventions significantly less effective, or much more expensive, than would otherwise be the case.

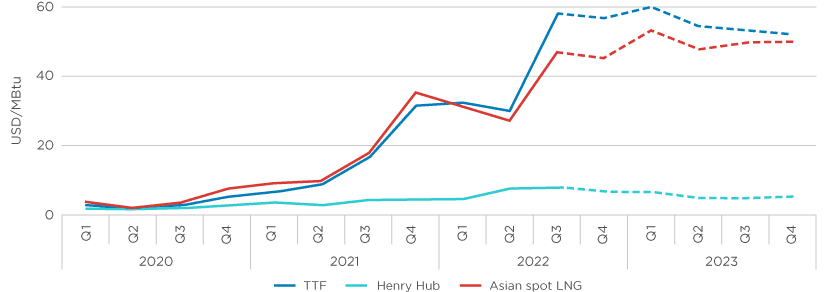

Responding to high energy prices

There has been an unprecedented increase in energy prices since 2020. Most European countries rely heavily on gas, which is the primary driver of the recent power price increase. This is because gas-fired power stations are typically the marginal generators of electricity, so their production costs drive power prices. In Europe, third-quarter 2022 Dutch gas prices (TTF) were more than eight times their five-year average. Asian spot liquefied natural gas (LNG) prices rose in Q3 2022 to their highest quarterly level on record (Figure 1). In Europe and Asia, forward curves as of the end of September 2022 expected prices to remain at high levels in 2023.

Figure 1: Main spot and forward natural gas prices, 2020-2023

Source: IEA, Gas Market Report, Q-4 2022

In these circumstances, governments across Europe have intervened to reduce the impact of energy price rises on households and businesses. Higher energy prices can have dramatic effects on consumers’ disposable incomes and well-being. Moreover, poorer households tend to spend a greater proportion of their incomes on energy than richer ones, making impacts on the poorest groups particularly severe. Governments’ concerns have also grown about small businesses and about inflation, which has exceeded 10% for the first time in decades in several European countries.[4]

While there has been some moderation in prices recently, the supply disruption following Russia’s invasion of Ukraine is likely to last. The European Commission warned in September 2022 that “the next winters – not just this one – will be difficult, make no mistake about that”.[5]

It is therefore important to review the various interventions governments have made to support households and businesses. Their efficacy varies. As do their secondary effects, including on the price of energy and the costs faced by government. There are likely to be ongoing challenges in coming winters to ensure that support schemes are well prepared to cover core consumption, especially for vulnerable consumers, while allowing price mechanisms to help balance supply and demand.

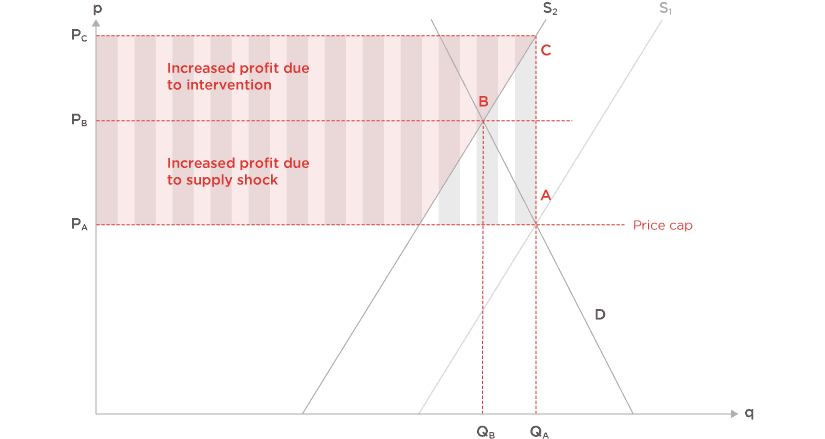

The effects of a supply reduction

It is helpful first to consider the effects of a negative shock to energy supply on prices and profits, without intervention. Figure 2 illustrates the relationship between prices and quantities in an energy market. The curve S1 shows the supply curve before a shock; this aggregates the short-term marginal costs of energy suppliers. The curve S2 represents the supply curve after a negative shock, such as a cut-off in Russian supplies of gas. For any given price of energy, there is less supply available. The curve D represents the demand of energy consumers.

Figure 2: The effects of a supply reduction

Both supply curves are upward sloping – production increases as prices increase – while the demand curve is downward sloping, because consumers reduce their demand at higher prices. However, demand and supply curves are quite steeply sloped. This is due to the expectation that energy supply and demand are relatively inelastic in the short term. Energy producers cannot quickly increase their production levels, while many energy consumers cannot reduce their demand without significant hardship.[6]

The supply shock moves market equilibrium from point A to point B. Quantities sold fall from QA to QB, while prices rise from PA to PB. If we assume that firms were making normal profit levels before the supply shock, the red shaded area illustrates the increase in profits (what we might call “windfall” profits [7]) due to the supply shock, and the green area shows lost profits. Consumer surplus, meanwhile, has fallen by the sum of the red and blue shaded areas.

This diagram illustrates how a supply shock can have dramatic impacts on market outcomes, with prices and profits moving particularly significantly when supply and demand curves are steeply sloped.[8] In general, this price mechanism has a beneficial effect – it ensures that those consumers with the lowest willingness to pay are the first to reduce their demand, and those producers with the lowest cost of producing more are the first to increase their supply. This means that the response to the supply shock is efficient, in the sense that, given prevailing market conditions, no one could benefit without someone else losing out.

We would expect some of this reduction in demand to come about due to changed behaviour by consumers who gain little value from one extra unit of energy. For instance, they might become more diligent in switching lights off in empty rooms, or switching the heating off when they go out. Governments aim to encourage such behaviour change to ease pressure on supply and prices.

However, the essential nature of energy to household well-being, and the scale of recent price rises, means that some consumers may be forced into cutting their consumption because they are unable to afford their basic energy needs. There can then be very significant hardship for those who reduce their consumption, or those who have to pay much more than expected. Indeed, in the UK, the NHS Confederation warned in August 2022 that there could be a public health emergency due to higher energy prices in the absence of intervention.[9]

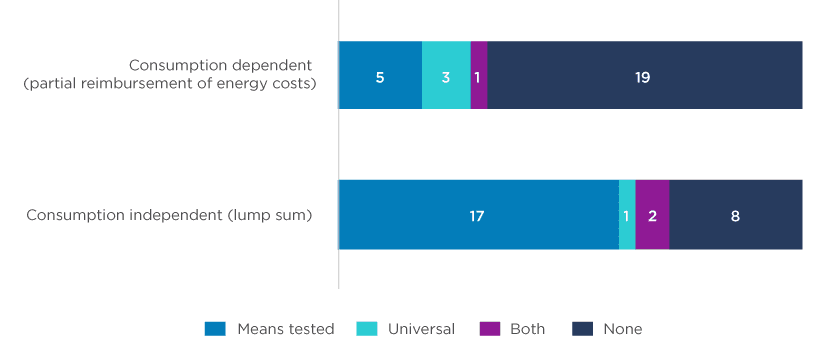

This makes it understandable that policymakers would want to intervene in the market to alter outcomes, supporting consumers to pay their energy bills. European countries have implemented four main categories of direct support measures. As Figure 3 illustrates, these are: lump sum cash transfers, either universally awarded or targeted at specific groups of consumers; and subsidies of energy bills, either universal or targeted. Each has different pros and cons, which we discuss in turn.

Figure 3: Overview of direct support instruments targeting households introduced in EU27+UK in 2022

Source: Bruegel, National fiscal policy responses to the energy crisis, 21 October 2022, accessed at Bruegel.

Cash transfers (lump sum payments)

The initial response of many European countries to the energy price rises was to provide cash transfers to households, whether targeted at more vulnerable households, or available to everyone.[10] For instance, in February 2022, the UK government announced a package of measures that promised most households payments of £350 to help pay their energy and housing tax bills.[11] Similarly, in March 2022, the German government agreed an expanded set of measures to help with energy prices, including one-off tax relief payments of €300, and an extra €100 for families on social benefits.[12]

Cash transfers have many advantages – they can be targeted at vulnerable households, typically have low administrative burdens and are quick to implement. They do not distort the operation of the energy market, meaning that they maintain incentives on households to reduce demand in response to high prices.

However, this can also be seen as the major downside of cash transfers. Because they are not linked to consumption, they do not reflect how high prices affect households in practice. A household in a well-insulated modern apartment in a warm part of the country might receive the same cash transfer as one in a poorly-insulated old house that is frequently exposed to very cold weather. The sense that the scale of earlier measures was insufficient to respond to the needs of some households has been an important driver of governments’ willingness in recent months to implement measures that subsidise energy costs directly.

Universal subsidies linked to energy consumption

Another option can be a universal subsidy linked to energy consumption for all households and businesses.

In Europe, partial reimbursement of energy costs has been implemented in Cyprus, Greece, Portugal and Sweden.[13] A price cap, setting the maximum amount that suppliers are permitted to charge per unit of energy consumed, has been introduced or modified in 2022 in Austria, Czechia, Estonia, Hungary, Lithuania, Montenegro, the Netherlands, Slovenia, Slovakia and the United Kingdom.[14] For instance, in the United Kingdom, the pre-existing price cap for gas and electricity rose to an annualised level of £4,279 in January 2023, but bill-payers were protected from much of this rise under the government’s Energy Price Guarantee, which limited the annualised bill for a house with typical consumption to £2,500 – from April, the Energy Price Guarantee will increase to £3,000.[15] Suppliers are typically reimbursed, in whole or in part, for the difference between the costs they incur and the amount they can charge consumers. Similarly, Bulgaria, France and Luxembourg have implemented freezes of the regulated price, or limited increases below what might have been expected.[16] For instance, in France in 2021, the Prime Minister promised to limit the increase in regulated tariffs to 4% for the whole of 2022.[17] For 2023, regulated tariffs can increase by up to 15%.[18]

This universal subsidy approach eases the affordability problem for consumers, but can be very expensive. The International Monetary Fund estimates that untargeted distortionary measures, largely universal subsidies, will on average cost European countries around 0.8% of GDP in 2022/23, more than half of the total fiscal cost of energy support measures.[19]

Figure 4: Impact of universal subsidies

At an appropriate scale, a universal subsidy scheme can dramatically improve affordability for consumers, and reduce the risks of serious hardship. But it is a blunt tool, which can introduce several other risks.

The subsidy measure increases the cost of the intervention because it blunts the incentives to reduce demand. To an extent, that is intended, in order to reduce hardship, but the universal scope of the subsidy also reduces incentives to cut back on the proportion of energy consumption that consumers would have been willing and able to give up if they had faced higher prices.

As a result, the price that the government pays for energy will be even higher than market prices in the absence of intervention, as is illustrated in Figure 4. At the capped price of PA, consumers wish to consume QA units of energy – the same as they were consuming before the supply shock. But higher prices are required to bring forward this amount of energy. The market price rises to PC, which is the corresponding price for QA on the new supply curve S2. Energy providers thus receive even higher profits, and the government pays the difference between PA and PC (grey shaded area).

In principle, “windfall” taxation of energy company profitability could limit the scale of this impact, and reduce the fiscal costs governments face. The European Council agreed levies on energy company profitability in September 2022, [20] and taxes on windfall profits have been implemented or extended in several European countries during 2022: the Netherlands in September, Romania in October, Cyprus, Greece, Ireland, Italy, the United Kingdom and Czechia in November, and Germany and Portugal in December.[21] Well-designed windfall taxes could transfer some of the surplus resulting from the energy supply shock away from firms and towards consumers or taxpayers. It is, though, important to ensure that the implementation of windfall taxes does not further reduce energy supply, and that any impacts on long-term energy investment are minimised.

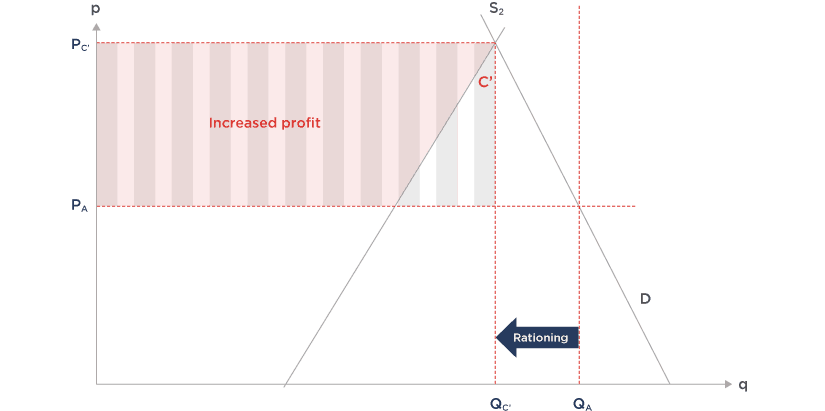

Moreover, universal subsidies can increase the risk that administrative rationing will be needed to mitigate the pressure on supply, for instance in the event of higher than expected demand due to a particularly cold winter, or a further constraint in supply. This can be seen in Figure 5, where at the capped price PA, consumers demand QA, which, due to an additional shock, supply can no longer meet at any reasonable price. In this case, administrative rationing is required to ensure demand falls to a level that can be supplied (Qc).[22]

Figure 5: Risk of rationing of supply

The possibility of rationing has been discussed in several European countries, though fortunately no significant administrative rationing has been needed so far.[23] If required, such administrative rationing can have significant negative consequences, since it is very difficult to estimate which energy uses are of highest value without price signals. Rationing can also encourage rent-seeking behaviour, whereby firms try to gain privileged access to the rationed supply.[24]

Targeted subsidies linked to energy consumption

An alternative approach to mitigate the effects of the supply shock is to subsidise the prices paid by some groups of consumers. The targeted group of consumers can take various forms: for instance, it could be households rather than businesses, or those households or businesses assessed as vulnerable.

In Europe, means-tested partial reimbursement of energy costs for households has been implemented in Belgium, Greece, Italy, Lithuania, Romania and Spain.[25] In October 2022, the Spanish government announced the creation of a “temporary” new category of electricity consumers (1.5 million households) entitled to a 40% discount on their bills. For businesses, the Irish government will provide eligible businesses with compensation of 40% of the increase in their energy bills (gas and electricity), capped at €10,000 a month.[26] In France, support for small and medium-sized enterprises, initially covering 25% of their consumption, was announced in October 2022.[27]

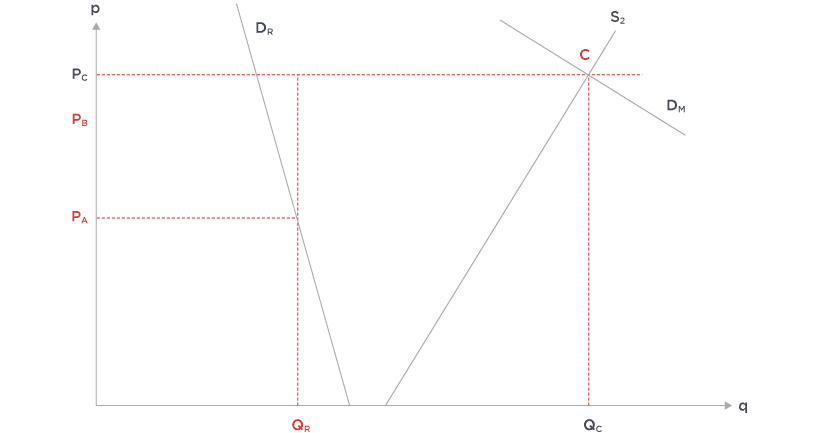

We can extend the setting above to consider the expected impacts of such subsidies on market outcomes, as illustrated in Figure 6. In this diagram, the price PB and the supply curve S2 are the same as in Figure 2 – they show energy supply following a cut-off in Russian gas supplies, and the price that would be charged without intervention. But demand is split between two groups, R (regulated prices) and M (market prices) (we can think of these as domestic and business consumers, or vulnerable groups and other consumers), with demand curves DR and DM. We assume that the demand curve is more steeply sloped for group R, reflecting for instance the expectation that domestic demand is more inelastic in the short term than business demand.

Figure 6: Targeted subsidies for domestic consumers

The left-hand part of the figure shows outcomes for consumers with regulated prices, which we assume to be capped at PA, the price before the supply shock. They consume quantity QR at this price, more than they would have done at PB. As a consequence, prices increase for everyone else, to a level higher than they would have faced without intervention. In the right-hand part of the figure, the curve DM shows demand from consumers exposed to market prices. Market prices are not capped, so prices are determined by the intersection between the demand and supply curves, at point C. Overall market prices are PC, while the total quantity of energy consumed is QC. Note that PC is higher than PB (and QC is greater than QB). This is because consumers facing regulated prices have no incentive to reduce their demand. Instead, all demand reduction comes about through the group of consumers exposed to market prices, and higher prices are therefore required to achieve the same level of demand reduction. The untargeted group faces the burden both of higher prices and of energy-saving efforts.

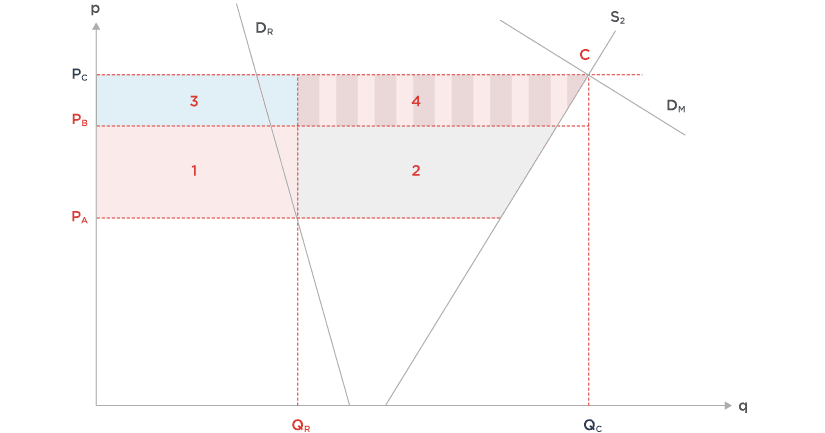

Figure 7 displays the welfare consequences of this intervention. As a result of the supply shock, suppliers’ profits increase by the sum of areas 1, 2, 3 and 4. Areas 1 and 2 are the same as the red shaded area in Figure 2 (as the price increased from PA to PB). However, area 1 is now paid for by the fiscal authority, rather than by consumers. Areas 3 and 4 represent additional profits for firms, due to the increase in prices following the subsidies. Area 3 is paid for by the fiscal authority, while area 4 is paid for by consumers exposed to market prices.

Figure 7: Welfare consequences of targeted subsidies

Therefore, relative to the situation without intervention, supplier profits are higher and consumers with regulated prices are better off, while the fiscal authority and consumers exposed to market prices are worse off. In addition, unlike in Figure 2, we observe some inefficiency – there are consumers with regulated prices who would be prepared to sell some of their energy to unprotected consumers at prevailing market prices.

These effects will be larger when the group of subsidised consumers is greater and when the demand of the subsidised consumers is more elastic (as this means more of the burden of adjustment will be borne by unprotected consumers).

The best of both worlds: core consumption subsidies?

The effects explained in Section 5 bring further insights for considering another type of targeted subsidy, in which support is targeted like a progressive income tax schedule. Consumers can buy a given amount of energy at a low price, then a further block at a higher price, and then consumption is exposed to market prices. The objective of this approach is to ensure that consumers are able to cover their essential needs, such as core heating, but there are strong incentives to reduce consumption at the margin. In principle, this could mean that there is little or no price-increasing effect of the subsidy, because consumer demand is not increased. Risks of administrative rationing should also be greatly reduced because consumers are still exposed to market prices. Moreover, even though the subsidy can be applied to all consumers, it is less costly than the universal subsidy discussed in Section 4 as it applies to only a proportion of energy consumption.

Approaches of this kind have been adopted by some European governments. For instance, both Austria and the Netherlands have introduced price caps on the first 2900 kWh of a household’s electricity consumption. In Croatia, there is a low price cap on consumption up to 2500 kWh, followed by a higher cap on additional consumption. Schools, kindergartens, universities, old people’s homes, NGOs, and administrative buildings pay a fixed price. Greece has implemented a subsidy along with household-specific incentives to reduce demand; consumers who cut their average daily consumption by 15% year on year receive a 50 euro subsidy per MWh consumed.[28]

Such policies hold out the hope of an appealing mix of government support for energy consumption that is really needed, good incentives on consumers to reduce demand in response to the supply shock, and relatively limited fiscal costs. However, it is always difficult to ensure that subsidies of this kind are targeted at those consumers that need them. For instance, larger households will typically have higher intrinsic energy needs, as will those in cold areas or poorly insulated houses – often private renters who have limited control over their energy efficiency. Moreover, longer term these policies could create risks of gaming by consumers, such as by dividing up households artificially to benefit from consumption subsidies.

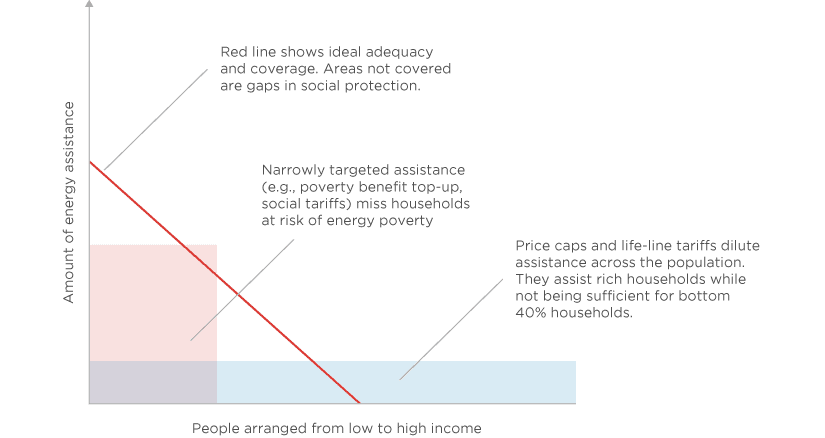

The trade-offs involved in subsidising energy consumption can be seen in Figure 8, created by the World Bank economist Nithin Umapathi. In this framework, the ideal approach would follow the red line, with high levels of assistance for the poorest groups, gradually tapering off as income increases. But in practice, governments face a trade-off between targeting assistance narrowly, as in the orange box, which could miss out lower to middle-income households, or providing broad-based support, which may be insufficient for the poorest groups. It should be noted, however, that while this framework is complicated enough in itself, governments will typically care about multiple dimensions of energy need, including for instance age and health status as well as income.

Figure 8: No subsidy scheme is likely to target consumers optimally

Source: Brookings, How to help people in Europe and Central Asia pay their energy bills, October 2022

Preparing for next winter and beyond

Overall, the scale and nature of European governments’ subsidies to energy demand can be seen as a reasonable reaction to a crisis situation that posed a serious threat to living conditions and well-being across the continent. However, as this article has shown, they have not come without costs. Subsidies have reduced the incentives on consumers to cut their demand, meaning that prices have risen still further and that the risks of administrative rationing have increased. Subsidies have boosted the already elevated profits of energy companies, at least in the absence of windfall taxation. The fiscal costs are also non-trivial; in November 2022, Bruegel estimated that Germany had committed 7.4% of its GDP to energy support measures, more than €260 billion.[29]

Beyond the issues covered here, there are also some wider economic risks of the interventions we have seen. This article has examined outcomes in a single energy market with a single government deciding whether to introduce subsidies. In reality, international energy markets are closely interlinked, particularly within Europe. This means that energy subsidies could have a snowball effect across markets. Subsidies in one country tend to increase prices both in that country and in neighbouring markets – potentially increasing the pressure for subsidies in neighbouring countries too. Moreover, because gas is priced in dollars, subsidy schemes in practice involve governments taking on substantial liabilities denominated in a foreign currency, with potential risks for perceived fiscal sustainability.

While energy prices have fallen somewhat recently, there is unlikely to be a quick fix to the problems faced by European countries. This means that policymakers should consider how future energy support schemes can be designed more smartly, with the twin objectives of providing support for essential use, particularly by vulnerable groups, and maintaining effective signals for reducing demand over time, through prices and other methods. This may include moving back to lump sum transfers that are not linked to energy consumption, or concentrating subsidies on core consumption only.

In the long run, the crisis has further suggested that the energy trilemma – the apparent trade-off between affordability, energy security, and decarbonisation – is no more. One of the tragic ironies of the current situation is that some environmental policies that countries postponed because they were too expensive, such as energy efficiency measures, might have easily paid for themselves in recent years.[30] The striking progress in reducing the costs of low-carbon generation such as wind and solar creates great opportunities for improving all three arms of the trilemma over time, with more affordable green energy that is less subject to global geopolitical developments.

Read all articles from this edition of the Analysis

View the PDF version of this article

[1] European Commission, Opening remarks by Executive Vice-President Timmermans and Commissioner Simson at the press conference on an emergency intervention to address high energy prices, September 2022, accessed at European Commission.

[2] Joe Perkins is a Senior Vice President and the Head of Research at Compass Lexecon. Clemence Rainaut is an Analyst at Compass Lexecon. The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

[3] Longer term, prices also affect incentives to invest in producing a good, and they influence the allocation of resources across different markets.

[4] See Eurostat, “Annual inflation up to 10.6% in the euro area, European Commission”. Available at: https://ec.europa.eu/eurostat/documents/2995521/15265521/2-17112022-AP-EN.pdf/b6953137-786e-ed9c-5ee2-6812c0f8f07f. Accessed 3 February 2023.

[5] European Commission, Opening remarks by Executive Vice-President Timmermans and Commissioner Simson at the press conference on an emergency intervention to address high energy prices, September 2022, accessed at European Commission.

[6] Typical estimates of price elasticity of demand consumers are around -0.1. That is, demand falls by around 1% for every 10% increase in prices. See, for instance, https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/532539/Annex_D_Gas_price_elasticities.pdf.

[7] This green area can be taken to represent the lost profits of those suppliers who are no longer in the market after the supply shock – for instance, Russian gas suppliers.

[8] If demand and supply were more elastic, quantities would change more, but prices and profits would change less.

[9] NHS Confederation, Could the energy crisis cause a public health emergency? 2022, accessed at NHS.

[10] We term as “cash transfers” measures that provide money to households that is not linked to the level of their energy consumption. In practice, these measures provide money in various ways, particularly through the tax or benefit systems.

[11] See https://www.gov.uk/government/news/millions-to-receive-350-boost-to-help-with-rising-energy-costs.

[12] See https://www.dw.com/en/germany-unveils-measures-to-tackle-high-energy-prices/a-61243572.

[13] Bruegel, National fiscal policy responses to the energy crisis, 21 October 2022. Available at: https://www.bruegel.org/dataset/national-policies-shield-consumers-rising-energy-prices.

[14] Bruegel, National fiscal policy responses to the energy crisis, 21 October 2022, Available at: https://www.bruegel.org/dataset/national-policies-shield-consumers-rising-energy-prices.

[15] See https://www.ofgem.gov.uk/publications/latest-energy-price-cap-announced-ofgem. The Energy Price Guarantee (EPG) reduces the unit cost of electricity and gas that consumers pay. The EPG will increase so that the bill for a consumer with typical consumption paying by direct debit will be £3,000 (expressed in annualised terms), compared with £2,500 – which was the maximum level up to 31 Match 2023. In addition, there are cost-of-living payments of £900 for those on means tested benefits, £300 to pensioners, £150 to those on disability benefits and doubling support for those on LPG or heating oil.

[16] Bruegel, National fiscal policy responses to the energy crisis, 21 October 2022, Available at: https://www.bruegel.org/dataset/national-policies-shield-consumers-rising-energy-prices.

[17] See https://www.cre.fr/Actualites/evolution-des-tarifs-reglementes-de-vente-d-electricite-hausse-de-4-ttc-au-1er-fevrier-2022.

[18] See https://www.ecologie.gouv.fr/hausse-des-prix-lenergie-toutes-mesures-soutien-mises-en-place-gouvernement.

[19] See https://www.imf.org/en/Publications/fandd/issues/2022/12/helping-europe-households-Celasun-Iakova.

[20] See https://www.bbc.co.uk/news/business-63089222.

[21] Bruegel, National fiscal policy responses to the energy crisis, 29 October 2022, accessed at Bruegel.

[22] Alternative energy saving approaches can help to mitigate the effects of subsidies on increasing demand. For instance, in September 2022 Germany implemented measures including a ban on retail stores keeping their doors open and limitations on the heating of public buildings, with the hope that they would reduce gas consumption by around 2%. See https://www.dw.com/en/germanys-energy-saving-rules-come-into-force/a-62996041.

[23] See https://www.reuters.com/business/energy/germany-might-consider-gas-rationing-uniper-ceo-2022-09-05/.

[24] Bulow and Klemperer, Regulated prices, rent-seeking, and consumer surplus, 2012, accessed at Bulow and Klemperer.

[25] Bruegel, National fiscal policy responses to the energy crisis, 21 October 2022, accessed at Bruegel.

[26] Bruegel, National fiscal policy responses to the energy crisis, 21 October 2022, accessed at Bruegel.

[27] See https://www.economie.gouv.fr/hausse-prix-energie-renforcement-dispositifs-aides-entreprises.

[28] See Bruegel, National fiscal policy responses to the energy crisis, 21 October 2022, accessed at Bruegel, and https://www.europarl.europa.eu/RegData/etudes/STUD/2022/699535/IPOL_STU(2022)699535_EN.pdf.

[29] See https://www.bruegel.org/dataset/national-policies-shield-consumers-rising-energy-prices.

[30] See, e.g., https://www.newstatesman.com/environment/2022/03/why-cant-the-uk-manage-to-insulate-its-homes.