The special merger regime for energy networks: lessons from the water sector

Share

The UK government has introduced legislation to reform merger assessment for electricity and gas network companies. The reform aims to protect the ability of the energy regulator, Ofgem, to set effective price controls by comparing network companies’ costs and performance. In this article, Joe Perkins and Orjan Sandewall [1] share lessons for the energy sector by drawing on their experience of a similar special merger regime in the water sector.

View the PDF version of this article.

The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients.

Introduction

The UK government recently introduced legislation to reform the merger assessment process for electricity and gas network companies.[2] This legislation proposes a special merger regime tailored for these companies. The regime aims to protect the ability of the energy regulator, Ofgem, to compare network companies’ costs and performance, which is an essential feature of its price control regime, RIIO (which stands for Revenues = Incentives + Innovation + Outputs). Since privatisation – in 1986 for gas networks and 1990 for electricity – there have been many mergers among energy network companies, [3] such that 10 companies now distribute and transmit gas and electricity in Great Britain.[4]

In this article, we explore the potential significance of the electricity and gas merger legislation, drawing on our experience of a similar special merger regime in the water sector. Since 2000, [5] eight mergers between water companies have been assessed under that regime.[6] We have advised the water services regulator, Ofwat, on the regime’s application, including during the 2021 merger between Pennon and Bristol Water. The parallels shed light on how the special merger regime for energy may differ from the typical process for mergers in unregulated industries, and on the role economic analysis plays.

Parallels between regulating water services and energy networks

Although they have differences, there are important similarities between how mergers could affect how Ofgem regulates energy networks and how Ofwat regulates water companies.

An overview of price controls

Both energy networks and water services are regional monopolies. In Great Britain, six companies own the operators of the 14 electricity distribution networks and four companies own the operators of the eight regional gas distribution networks. Three of those companies also own the gas and electricity transmission licences.[7] Similarly, in England and Wales there are 16 regional monopolies that provide wholesale water services and retail services to households, of which 11 also provide wholesale wastewater services.[8] Unlike in the energy sector, water retail services for households are also regional monopolies.

Figure 1. Current structure of regional monopolies subject to price regulation by Ofwat

Given the absence of direct competition within a region, Ofgem and Ofwat control the prices that operators of these monopolies can charge their customers. In energy, network operators charge retail energy suppliers, with charges ultimately passed on to final consumers. Those regulated charges represent only a proportion of consumers’ energy bills, but they are still substantial: in 2020, network charges accounted for around a quarter of the energy bill for a typical household.[9] Both Ofgem and Ofwat must also consider incentives to invest and maintain the quality of the network. For instance, Ofgem must ensure that operators’ revenues are set "at a level which covers the companies’ costs and allows them to earn a reasonable return subject to them delivering value for consumers, behaving efficiently and achieving their targets as set by Ofgem.” [10]

Both regulators control prices in fixed five-year periods. Ofgem’s latest round of price reviews controlled revenue between 2021 and 2026 for gas transmission and distribution and for electricity transmission, and between 2023 and 2028 for electricity distribution.[11] Likewise, Ofwat’s 2019 price review process set revenue for 2020-2025.

Cost comparisons are a core feature of these price reviews. Both regulators compare costs across different companies in order to estimate an efficient allowance that would protect customers from overcharging, while allowing the relevant operator to invest sufficiently. For instance, Ofwat calculates revenue controls by comparing costs across suppliers in different regions, employing econometric modelling to estimate the costs that an efficient supplier should achieve (which we will refer to below simply as the “cost estimates”). This analysis takes into account various factors that may influence costs but are beyond the control of the supplier, such as population density.

The impact of mergers and the role of the special merger regime

A merger between providers of water services, or energy network operators, does not pose a threat to competition in the same way as it might in unregulated industries, because there is no direct competition between merging parties. However, a merger can harm the regulator’s ability to set effective price controls.

To model and compare cost estimates well, it is important that Ofwat analyses cost information from a diverse range of suppliers. This helps Ofwat to distinguish between low costs that arise from efficiencies from low costs that result from favourable conditions, such as high population density. Consequently, a reduced number of regional suppliers could hinder Ofwat’s ability to benchmark costs accurately and determine an efficient allowance for each company.

To address this concern, the Water Industry Act 1991, amended by the Water Act 2014, requires the Competition and Markets Authority (“CMA”) to evaluate whether certain mergers would impede Ofwat’s ability to compare water enterprises. However, mergers that generate “relevant consumer benefits” may be exempted from this requirement. In this evaluation process, the CMA relies heavily on the opinion of Ofwat.

It should be noted that Ofwat’s comparisons across water enterprises are not limited to costs; performance on outcomes is also compared across enterprises. Such comparisons tend not to require econometric approaches and can more reliably be performed with fewer observations; for this reason, the remainder of this piece focuses on cost comparisons.

The proposed energy merger regime follows the template provided by the equivalent regime for water services. The legislation recently introduced by the UK government seeks to protect Ofgem’s ability to set effective price controls by amending the merger regime for energy network companies. The draft legislation would require the CMA to assess whether a merger “has caused, or may be expected to cause, substantial prejudice” to Ofgem’s ability to compare energy network companies. If the CMA considers that this has happened or may happen, it could prohibit the merger or require remedies from the merging parties. But it can decide not to do so, if it believes that relevant consumer benefits outweigh this effect. In this process, the CMA must request and consider Ofgem’s opinion.[12]

The UK government estimates that the reformed merger regime for energy network companies could save energy consumers up to £420 million over 10 years.[13]

A case study from the water sector – the Pennon / Bristol merger

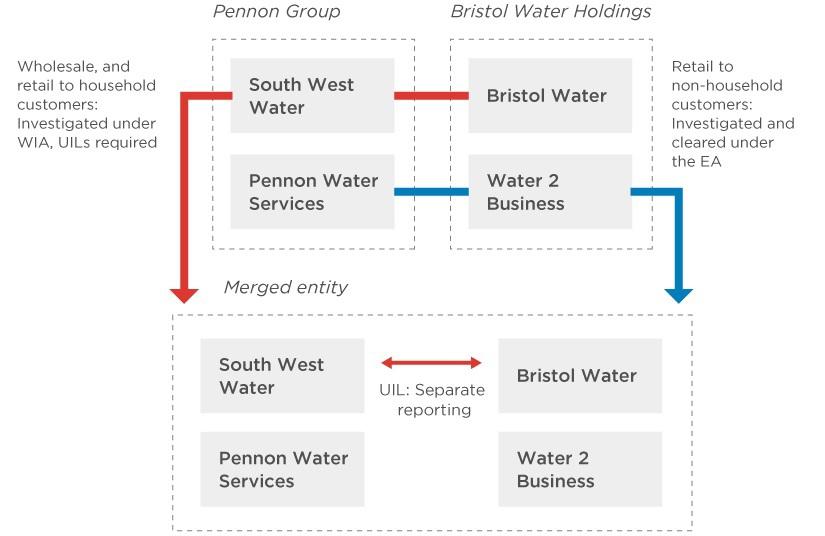

The recent acquisition by Pennon Group of Bristol Water [14] serves as a prime example of how one transaction can undergo investigation under two distinct regimes – the typical assessment process that a merger in any sector might undergo, and the special merger regime for water companies – each addressing specific aspects.

First, the merger was cleared under the provisions of the Enterprise Act, which is the merger regime applicable to most mergers. This decision focused on the consolidation of retail water and sewerage services for non-household customers.

However, recognising the importance of preserving Ofwat's ability to compare water enterprises, the merger was also subject to investigation under the provisions of the special water merger regime. This investigation specifically assessed the impact of the merger on water and sewerage services for household customers (i.e., as opposed to non-household customers).

Figure 2. Pennon / Bristol merger – overview of merger processes

Source: CMA (2022), Pennon Group plc / Bristol Water Holdings UK Limited merger inquiry, decision on duty to refer under WIA 1991.

Notes: (i) This merger also involved other entities where there was no overlap between the parties.

(ii) This figure does not account for any post-merger integration activities in the non-household sector. (iii) Pennon Water Services was an 80/20% joint venture with South Staffordshire plc.

(iv) Water 2 Business was a 30/70% joint venture with Wessex Water Limited.

(v) From April 2016, South West Water’s licence under the WIA also covers the Bournemouth area, following the merger of Bournemouth Water’s trade and assets into South West Water Limited.[15]

(vi) “WIA” refers to the Water Industry Act 1991. “EA” refers to the Enterprise Act 2002. “UILs” refers to “Undertakings In Lieu”.

In the latter investigation, after determining whether the merger involved two suppliers with similar activities and characteristics (known as an “overlap” in this context), the CMA pursued several lines of inquiry.[16] These included:

- assessing how the merger would affect cost benchmarks;

- examining the number and usefulness of remaining comparators; and

- evaluating the potential loss of an important comparator that offers significant value due to similarities to or differences from remaining comparators.

Additionally, the CMA considered whether Ofwat should modify its use of comparators to mitigate the merger's impact.

The CMA required undertakings to prevent referral of the merger for a phase 2 investigation. In this case, the CMA did not find sufficient evidence to conclude at phase 1 that relevant consumer benefits would outweigh its findings on the impacts of the merger.

The merging parties offered to provide separate reporting information for South West Water (a division of the Pennon Group) and Bristol Water, and acknowledged and agreed that Ofwat would maintain separate price controls for the wholesale water activities of South West Water and Bristol Water, an arrangement that the CMA accepted. These undertakings were designed to ensure that the comparators available to Ofwat remained unaffected, and to enable Ofwat to continue setting separate revenue controls for wholesale water for these two entities.

Assessing the impact of mergers on Ofwat’s ability to estimate costs

The CMA’s lines of inquiry involved extensive quantitative analysis of issues not normally assessed in mergers examined under the standard merger regime of the Enterprise Act. We provided assistance to Ofwat in addressing several of these, which we discuss below, and which are also potentially relevant to the new energy merger regime.

Assessing how the merger would affect cost benchmarks

First, when assessing how a merger would affect Ofwat’s cost benchmarks, it is crucial to consider how the merger would affect the level of efficient cost estimates, and the precision with which they are estimated.

To assess the impact of the merger on the level of the cost estimates, comparisons can be made between the outcomes of previous price review processes and counterfactual analyses that assume the merging parties had already consolidated before the most recent price review. This backward-looking analysis can be complemented by forward-looking analysis, which takes into account how likely it is that a particular company’s costs are to change over time. Given that the most efficient firms are typically used to determine the ‘frontier’ level of efficient costs that other firms should aim to achieve, it is particularly relevant to consider whether a company is likely to become one of the most efficient firms in the industry.

To assess the impact on the precision or reliability of cost estimates may involve examining how the merger affects the statistical properties of cost estimates, such as their variance, or by considering how sensitive cost estimates are to small changes in assumptions, both with and without the merger.

The relationship between the level of efficient cost estimates and their precision matters. Somewhat counterintuitively, even if a merger leads to lower efficient cost estimates, this may not be desirable from a policy perspective. This is for two principal reasons.

- The goal of the regulatory price review process is to arrive at the most accurate cost estimates, rather than the lowest estimates. Lower estimates would mean lower prices for consumers on average across the industry in the short term, but may harm them in the long run. Setting cost allowances below actual efficient costs could result in insufficient revenues for water enterprises, hindering their ability to provide adequate service quality and to make necessary investments.

- Revenue regulation occurs at the level of individual regional water enterprises. Even if cost estimates are correct on average across the industry, shifting cost estimates for individual companies may create undesirable situations, such as overcharging customers in certain regions while leaving water enterprises in other regions underfunded.

Examining the number and usefulness of remaining comparators

A second important assessment is to identify the cumulative impact that consolidation has on the number and usefulness of remaining comparators, not just the incremental impact that the specific merger has on its own. This is to avoid the situation where a regulator agrees to a sequence of mergers, each of which might have only a limited impact on the ability to set price controls, but which have a significant cumulative effect. (This is similar to the thinking behind the “Sorites paradox”, where one grain of wheat does not make a heap, and therefore nor do two grains since that is only one grain more, nor three, etc., leading to the paradoxical conclusion that a million grains also do not make a heap. Or in bleaker, more colloquial, terms: the frog that stays in a warming pot, as it gradually rises to boiling point.)

Figure 3 below shows an illustrative example of this aspect, as presented by Ofwat in its opinion on the Pennon / Bristol merger. This shows that the incremental loss of precision from losing a comparator may be small, but the cumulative effect can be much larger. In this example, , the incremental loss of precision from losing a comparator remains below 5% for each individual merger up to the point where ten comparators remain – but the cumulative loss of precision when moving from 19 comparators to 10 is more than 40%.[17]

Figure 3. Illustrative example – incremental and cumulative loss of precision when reducing the number of comparators

Source: Ofwat (2022), “Opinion on Pennon’s acquisition of Bristol Water”, Figure A.5.1.

Evaluating the potential loss of an important comparator

Third, the identity, not just the number, of remaining comparators matters. Some companies offer significant value as a comparator, due to important similarities to or differences from the other companies. Removing a particular company that offers significant comparative value could have a much larger impact on efficient cost estimates for the remaining companies than removing a less significant company. As an illustrative example, we randomly removed four of the comparators used in the 2019 price review process and recalculated the efficient cost estimates for each of the remaining water enterprises (we did this separately for retail and wholesale water). We then repeated this exercise 99 times, to obtain in total 100 randomly drawn scenarios where four comparators had been removed.

Figure 4 below illustrates how the estimate for each of the 17 companies’ efficient costs would have varied from the allowance Ofwat actually allowed, depending only on which four of the other companies were removed from the comparisons informing that assessment. Each “box and whisker” shows the range of cost estimates (from the lowest estimate at the end of the left whisker, to the highest estimate at the end of the right whisker). The “box” indicates the middle (median) estimate, and the 25th and 75th percentiles of estimates – all estimates are shown indexed against the result of the 2019 price review process (which is set at 100).

Figure 4. Illustrative example – the impact on retail cost estimates of different water enterprises when randomly removing 4 comparators (cost baseline = 100)

Source: Compass Lexecon calculations.

Each company’s allowance varies considerably, depending on which 13 companies remain to inform its allowance. For example, at one extreme, a particular set of comparators would have reduced Supplier A’s efficient cost estimate by as much as 14% (taking it from the baseline of 100 down to 86). At the other extreme, a different set of comparator companies would increase its cost estimate by 16% (taking it from the baseline of 100 up to 116). Where Supplier A remained in the market, in 25% of scenarios, its cost estimate was reduced by 8% or more, in half of scenarios its cost estimate was reduced by 3% or more, and in 75% of scenarios its cost estimate increased by 1% or less.

Other water enterprises were less affected. For all companies, removing some companies increased their allowance, and removing others decreased it. For 11 of the companies, their costs decreased more often than they increased, while for the other 8, they increased in more scenarios.

Lessons for the energy sector and future work in the water sector

As the UK government introduces a new special merger regime for energy network companies, it is important to draw insights from the established special merger regime in the water sector. These include:

- Mergers can have detrimental effects resulting from the loss of comparators and the regulator’s ability to assess costs. Assessing such detrimental effects requires a different toolkit from that used in standard merger assessments, including in particular the ability to estimate how a merger is likely to affect Ofgem’s ability to estimate accurately the efficient costs of regulated firms.

- The expected benefits from the merger should be weighed up alongside the potential detriment to consumers. The limited number of academic studies in this area suggest there can be significant benefits of network company mergers. For instance, in a study of Norwegian electricity sector mergers, Argell, Bogetoft, and Grammeltvedt (2015) find benefits in terms of increased staff productivity and outsourcing of services, as well as catch-up of inefficiency.[18] However, quantitative evidence is particularly important when assessing whether the intended benefits are likely. In the case of the merger between Pennon and Bristol Water, the CMA assessed both Pennon’s and Ofwat’s views on expected benefits, concluding that “Pennon did not provide enough evidence to support the characterisation of most of its benefit claims as RCBs [Relevant Consumer Benefits]. In fact, most of Pennon’s benefit claims were not quantified nor supported by concrete evidence.”[19]

- Analysis of mergers between regulated companies needs to take account of the likely evolution of the price control process over time. This includes both positive aspects, such as Ofgem’s ability to optimise for fewer firms, and negative aspects, such as a merger reducing Ofgem’s freedom of manoeuvre in the future (for instance, its ability to choose a different regulatory approach). Firms may contemplate mergers with the intention of "gaming" the system, aiming to achieve more favourable outcomes from the price review process. As a counter, Ofgem could use this as a screening criterion when evaluating mergers: if a merger would increase the cost allowance of the merging parties by a significant amount, it may warrant a more thorough investigation.

- Finally, it is important to clarify what can and cannot be remedied and assess the effectiveness of separate reporting requirements. As in the case of the Pennon / Bristol Water merger, the CMA may judge that separate reporting requirements and price controls are sufficient to remedy any potential adverse effects of a merger. However, separate reporting units may still cause problems for Ofgem, for instance if the allocation of common costs within the corporate group can be manipulated to obtain a more favourable outcome from the price review process. Furthermore, mergers raise challenging questions regarding how to benchmark the cost of capital, as post-merger capital may be raised at the group level. On the other hand, separate reporting requirements could make it harder to achieve the efficiency benefits of a merger, for instance if they make it harder to manage the merged firm as a combined entity.

In conclusion, the proposed new merger regime for energy network companies will involve new forms of quantitative analysis which will require significant input from the merging parties, particularly concerning the level and precision of cost estimates. It is likely to increase the volume of technical analysis required at phase 1 compared to the standard merger regime, as is the case for the special merger regime in the water sector. From Ofgem's perspective, it is important to establish a robust and transparent methodology for how it will approach future mergers of energy network companies, including difficult questions such as how to consider dynamic effects in the context of evolving price control processes and the potential for increasingly imprecise estimation as more mergers take place.

Read all articles from this edition of the Analysis

View the PDF version of this article

[1] Joe Perkins is a Senior Vice President and the Head of Research at Compass Lexecon, and was formerly chief economist at the energy regulator Ofgem. Orjan Sandewall is a Vice President at Compass Lexecon. The views expressed in this article are the views of the authors only and do not necessarily represent the views of Compass Lexecon, its management, its subsidiaries, its affiliates, its employees or its clients. This article draws upon work the authors carried out on behalf of Ofwat in 2021 and 2022.

[2] “Energy Bill”, 2023 (HL Bill 295, 2022-2023), London: The Stationery Office, accessed May 2023.

[3] See the mergers listed in UK Parliament (2022), “Energy Bill – Impact Assessments (IA)”, p. 106, accessed May 2023. For the most recent mergers, see: CMA, “Macquarie and BCI / National Grid gas transmission and metering”, and CMA, “National Grid / PPL WPD Investments Merger Inquiry”, accessed May 2023.

[4] UK Parliament (2022), “Energy Bill – Impact Assessments (IA)”, p. 105. These companies are: Scottish & Southern Electricity Networks, SP Energy Networks, Electricity North West, Northern Powergrid, UK Power Networks, National Grid, Scotia Gas Networks, Northern Gas Networks, Cadent Gas, Wales & West Utilities.

[5] See the mergers listed in Ofwat (2022), “Opinion on Pennon’s acquisition of Bristol Water”, para A3.13. See also CMA, “Pennon Group plc / Bristol Water Holdings UK Limited merger inquiry”, accessed May 2023.

[6] The current regime dates from the Water Industry Act 1991, amended by the Water Act 2014. CMA (2015), “Water and sewerage mergers: Guidance on the CMA’s procedure and assessment”, para 1.1. and 1.8.

[7] UK Parliament (2022), “Energy Bill – Impact Assessments (IA)”, p. 105. Various companies are active across multiple energy networks: National Grid is active in both electricity and gas transmission and in electricity distribution; Scottish and Southern Electricity Networks and SP Energy Networks are active in both electricity transmission and distribution. There is some degree of common ownership: National Grid owns 39% of the shares of Cadent Gas, active in gas distribution; the member companies of CK Group Infrastructure UK are shareholders in UK Power Networks, active in electricity distribution, and in Northern Gas Networks and Wales & West Utilities, both active in gas distribution. Links accessed in May 2023.

[8] See Ofwat, “Contact details for your water company”, accessed May 2023. Among these, Hafren Dyfrdwy and Severn Trent Water belong to the same group, Severn Trent Plc Group. Links accessed in May 2023.

[9] The “typical” household has median consumption levels and uses both electricity and gas. Network costs are 28% of a typical bill for gas, 23% for electricity, and 25% of a dual fuel bill. Ofgem, “Breakdown of a gas bill”, “Breakdown of an electricity bill”, “Breakdown of a dual fuel bill”, accessed May 2023.

[10] Ofgem (2013), Factsheet 117: “Price controls explained”.

[11] Ofgem, “Network price controls 2021-2028 (RIIO-2)”, accessed May 2023.

[12] Specifically in the legislation, it must consider the opinion of the Gas and Electricity Markets Authority, which is Ofgem’s board. “Energy Bill”, 2023 (HL Bill 295, 2022-2023), London: The Stationery Office, schedule 14, pp. 322ff., 68B, 68C, 68D, accessed May 2023.

[13] UK government (2023), Guidance: “Energy Security Bill factsheet: Energy network special merger regime”, accessed May 2023. See also UK Parliament (2022), “Energy Bill – Impact Assessments (IA)”, p. 103.

[14] CMA, “Pennon Group plc / Bristol Water Holdings UK Limited merger inquiry”, accessed May 2023.

[15] South West Water, Bournemouth Water (2018), “Trading and Procurement Code”, p. 2.

[16] CMA (2015), “Water and sewerage mergers: Guidance on the CMA’s procedure and assessment”, para 4.15.

[17] Ofwat (2022), “Opinion on Pennon’s acquisition of Bristol Water”, pp. 84-85.

[18] P. J. Agrell, P. Bogetoft and T. E. Grammeltvedt (2015), "The efficiency of the regulation for horizontal mergers among electricity distribution operators in Norway" 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, pp. 1-5, doi: 10.1109/EEM.2015.7216685.

[19] CMA (2022), Pennon Group plc / Bristol Water Holdings UK Limited merger inquiry, decision on duty to refer under WIA 1991, para 203.